Frequently Asked Questions

What are DERIVATIVES?

Derivatives are financial instruments without any independent value. Their value is derived from underlying assets such as index, stock, commodities bullion or currency. For example, a derivative of ITC share will derive its value from the share price (current market price) of ITC. In derivatives trading, the contract is traded and not the underlying asset.

What are the advantages of derivatives trading?

- Derivatives act as a good hedging tool against price volatility.

- You can take a high exposure on a stock or security by paying a small margin. For example: If the stocks are priced at Rs 10 lakh and you have only Rs 2 lakhs in hand, this product will still help you take a position.

- Derivatives offer huge time leverage, which is a big plus for traders who do margin trading.

- You can hold the position for 3 months. Normal margin product- 1 day, E-Margin product T+2 days.

What are the different types of derivatives?

- Futures: In futures trading, it is the owner responsibility to buy or sell a contract at a pre-defined time and price. Here, there are standard conditions to follow.

- Forward: It is the owner’s responsibility to buy or sell a contract at a pre-defined time and price. However, it the conditions can be customised between the buyer and seller.

- Options: In options trading, the owner has the option to buy or sell something at a pre-defined price and time.

- Swap: Swap is an agreement of barter or exchange of a sequence of cash flows between two parties.

How do Futures Contract work?

Futures Contract is a contract to buy or sell pre-defined quantities of an instrument at a specified price and time.

- Future contract has standardised conditions such as price, quantity and time.

- The owner of the contract has the obligation to buy or sell in future.

- Price is determined by supply and demand factors in secondary market.

- Index futures was the financial derivative launched in India.

- Every contract expires on last Thursday of the expiry month.

Terminologies used in Futures

Spot Price: the trading price of the asset in the spot market.

Future price: the price of future contracts in futures market.

Contract Cycle: Validity period for trading in contracts.

Contract Size: Amount of the asset to be delivered in specified time.

Expiry date: The date on which validity of contract ends.

Initial Margin: Amount to be deposited in margin account to start trading.

Maintenance Margin: Minimum amount to be maintained for trading.

Cost of Carry: Storage cost plus interest paid to finance the asset.

Mark to Market: Adjustments (Profit or Loss) made to investor’s margin account based on future closing price.

Types of Futures Contracts

In terms of Underlying Asset

- Index Futures

- Stock Futures

In terms of Expiry

- Near Month

- Next Month

- Far Month

Example:

You buy 1 contract of Nifty Futures at Rs 9000

Total contract value is 9000 x 75 (Size of the Lot) = Rs.6,75,000.

Margin is approximately 15%.

This means you pay only Rs.1,01,250 and get control of the contract worth Rs.6,75,000.

If Nifty moves to 9300, you make a PROFIT of Rs 300 (9300-9000)

Total profit is 300 x lot size of 75 = 22500.

You earn a return of 22.2% (15000/40500) x 100 even as nifty moved only 3.33%.

Understanding Options

- The owner has an option to buy or sell the contract at a pre-defined price.

- Purchaser of option has to pay something for this contract - in form of a premium.

- You can sell/write options and receive an option premium from the buyer.

- A seller is obliged to sell/buy an asset if the buyer exercises it on him.

TYPES of Options

CALL Option- Right (not an obligation) to BUY the contract.

PUT Option- Right (not an obligation) to SELL the contract.

Index Options – An Index is the underlying asset.

Stock Options – Stocks act as the underlying asset.

Terms used in Options Trading

Stock Options: A contract which gives buyer the right or buy or sell stocks at pre-fixed price.

Writer: The one who is obliged buy/sell asset if the buyer pays him premium.

Buyer: The one who pays a premium and buys the right (not obligation) to exercise option on the writer/seller.

Strike Price: Price specified in an Options Contract, which is also called exercise price.

Premium/Option Price: The price a buyer pays to sell/writer of option.

In-the-money option – Brings a positive cash flow to the holder if exercised immediately. A call option is in-the-money if the current market price of underlying asset is higher than strike price.

At-the-money option – Brings zero cash flow if exercised immediately. A call option is at-the-money if current market price of underlying asset equals strike price.

Out-of-the-money option – Brings negative cash flow if exercised immediately. A call option is out-of-the-money if current market price of underlying asset is less than strike price.

Expiration Date: Date specified in the contract, which is also known as strike date or maturity date.

American Options: Options that can be exercised at any time up to expiration date.

European Options: Options, which can be exercised only on expiration date.

Components of Option Pricing

Intrinsic Value: is the amount the option is in the money. If the option is OTM or ATM, its intrinsic value is zero.

Time Value: Difference between Premium paid and intrinsic value.

OTM and ATM options have only time value. Longer the time to expiration, greater is an option’s time value. At expiration, an option should have no time value. A contract has maximum time value when it is ATM.

Difference between Futures & Options

Futures and unlimited profit or loss potential.

Options have limited risk and unlimited profit potential.

Types of Options

CALL Option- Right (not an obligation) to BUY the contract.

PUT Option- Right (not an obligation) to SELL the contract.

Index Options – An Index is the underlying asset.

Stock Options – Stocks act as the underlying asset.

Example

You buy a stock option by paying a premium of Rs.25.

Lot size is 500, total premium paid is Rs.25 x 500 = Rs.12500.

Current Market Price in cash market is Rs.900.

Now if the stock moves to Rs.1000, option premium would roughly increase to Rs.125.

That translates into a return of 400% as against 11% return in cash market.

What is a derivative?

A derivative is a contract between two or more parties to buy and sell an asset at a predetermined price and time in the future.

All derivatives are secondary financial instruments whose value is derived from underlying primary assets like equities, currencies, commodities market indices etc. They can be either traded on the exchange or over-the-counter. The commonly used derivatives are - Forward Contracts, Futures, Options and Swaps.

Futures and Options are the only standardized contracts that are traded on an exchange, allowing investors to buy and sell them. They offer high leverage and hedging potential.

Speculation is often thought to be the basis of derivatives trading. For Example; if a trader expects the markets are likely to fall, he/she can create a short position, whereas a trader who believes the markets may go up, would create a long position. If a trader expects the markets to trade sideways then he would short his options.

What is a Futures Contract?

It is an agreement between two parties to buy or sell an asset at a certain time in the future at a certain price. One needs to have sufficient margin in his account to create a future position. It can be either in the form of cash or collateral. A margin is charged to both the buyer and the seller as they carry unlimited risk.

There are two positions a futures trader can take; a long futures position or a short futures position.

Long futures: A trader takes a long futures position when he expects the markets to go up. If the markets move in the direction of the position taken, he would make money. If not, he would lose money

Short futures: A trader takes a short futures position when he expects the market to fall. If the market goes down, he would make money. If the market goes up, he would lose money.

Example of futures trading:

Mr. Sharma buys a futures contract on the exchange which entitles him to receive 100 shares of ABC Industries after three months at a price of Rs 350 per share. The counter-party to the contract, Mr. Tripathi has an obligation to deliver the 100 shares of ABC after three months and receive Rs 350 per share. Let’s assume the current market price of ABC is Rs. 350, we could have three situations tomorrow

- The price moves up to Rs 360 per share. This means Mr. Sharma would be in profit of 10 points

- The price falls to Rs 340 per share. This means Mr. Tripathi would be in profit of 10 points

- The price remains unchanged at Rs 350 per share. In this case, neither Mr. Sharma nor Mr. Tripathi will have to pay or receive anything.

What is an Option?

An option is a financial derivative that represents a contract sold by one party (the options writer) to another party (the option holder)

The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security at an agreed-upon price (strike price) during a certain period of time on a specific date (expiration date).

Why should one trade in Options?

Unlike in the case of futures where the loss one can incur is unlimited. If one buys an option, the maximum loss he will have to incur in case the trade goes against him will be the premium paid, while the profits he can earn is unlimited. When one sells an option, the possible loss incurred can be unlimited, the profit, however will be limited to the premium received.

The Premium could be anything that a strike commands. Even if I have, say, Rs 1000, I can still participate in the market by buying an option, but the same will not be possible in the case of Futures.

What is a call option?

It gives the buyer the right, but not the obligation, to buy a given quantity of the underlying asset at a given price at a future date. A trader who expects the markets to go up, will buy a call option. The maximum loss the buyer of an option could incur would be the premium paid, however, the profits can be unlimited. When a trader sells an option, his loss can be unlimited, however, his profits would be limited to the premium received

What is a put option?

It gives the buyer the right, but not the obligation to sell a given quantity of the underlying asset at a given price on a given date. A trader who expects the markets to go down, will buy Put options. The maximum loss the buyer of an option could incur would be the premium paid, however, the profits can be unlimited. When a trader sells an option, his loss can be unlimited, however, his profits would be limited to the premium received.

What are the advantages of trading in equity derivatives?

Transfer of risk:

Derivatives help a risk averse trader transfer his/her risk to a risk taker.

Lower transaction costs:

The cost of trading in derivatives is comparatively lower than other segments.

High leverage:

The capital required for taking positions in derivative instruments is generally much lesser as compared to the capital needed to take positions in the stock markets.

One can leverage the existing stocks and post deducting the haircut, one and can trade in derivatives against the limit generated. We don’t charge any interest on such trades. In the case of Futures, only 20%-40% of the total contract value is required to start trading under normal conditions, whereas, in Options, only the premium amount is required in order to buy an Option

What kind of instruments are traded in the equity derivatives segment?

Index and Stock

How much margin do I need to pay in order to participate in future contract?

Margins can vary from stock to stock. Margins are prescribed by exchanges and the same needs to be maintained during the course of holding the future contract. If at any given point of time the margin is less than the prescribed margin by the exchange, then the exchanges levies a penalty from the client.

What is the margin that needs to be paid while buying an option?

The buyer of an option only pays a premium. For an option buyer the maximum loss can be the premium paid, however, profits can be unlimited.

What is the margin that needs to be paid while writing/selling an option?

The Writer or Seller of an option pays a margin. Generally, it’s the same as a future contract. The loss an option seller can incur could be unlimited, however, the profits are limited only to the extent of the premium received.

What is Initial margin

Initial margin includes Span margin + Exposure Margin + Delivery margin

Span Margin: Span margin is the minimum margin blocked in order to trade in Future or to sell Options

Exposure Margin: It is the margin required over and above span margin to cover MTM

What is Delivery margin and how is it calculated

Delivery margins are levied on the lower of potential deliverable positions or in-the-money long option positions, four days prior to the expiry of a derivative contract which has to be settled through delivery.

Delivery margins at the client level shall be computed as per the margin rate applicable in the Capital Market segment (i.e VAR, Extreme Loss Margins) of the respective security. Delivery margins shall be levied at the client level and collected from the clearing member in a staggered manner as under

| Days to Expire | Delivery Margin |

| Expiry – 4 EOD | 10% of Delivery margin computed |

| Expiry – 3 EOD | 25% of Delivery margin computed |

| Expiry – 2 EOD | 45% of Delivery margin computed |

| Expiry – 1 EOD | 70% of Delivery margin computed |

Example- If the expiry of a derivative contract is on Thursday, then the delivery margins on the potential in-the-money long option position shall be applicable from the end of trading day of the preceding Friday.

Is the margin same for all contracts? – No. Margins differ from stock to stock. It depends on the volatility of the stock. Higher the volatility, greater the margin

How is margin charged by HDFC Securities Limited? – Margins charged by HDFC Securities are as prescribed by the exchange.

Can I use my shares as pledge? – Yes. The existing portfolio can be used to trade in F&O without any interest charges, however “X” haircut is applicable post which you can trade with the limit generated

What is the interest charged when I use my shares as pledge?– We don’t charge any interest when you use your shares as pledge for fulfilling the margin requirement for buying / selling a future contract and writing / selling an option contract. However, an interest charge is levied in case there is a deficiency or margin shortfall.

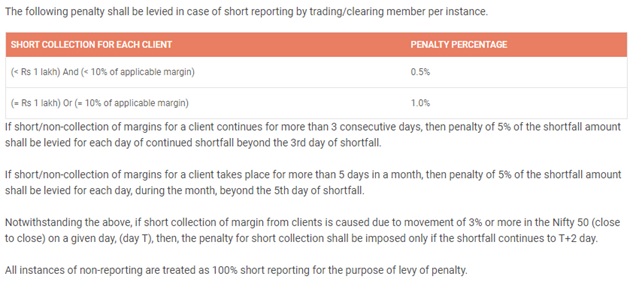

Is a margin shortfall reported to the exchange liable for penalty?

Yes. Such a position is liable for penalty and the penalty charged is as follow:

What are the futures contract months one can participate in?

Three contract months are available for trading:

Current / Near month – The month in which the expiration date is closest to expiry (the last Thursday of every month). Trading is usually most active in the current month

Mid month – Mid month is the month after the current/near month. Trading is usually less active compared to trading in the current/near month.

Far month – This is the third month to the current/near month. Trading or volume is much lower as compared to current or mid-month.

What is mark to market (MTM)?

MTM is a simple accounting adjustment. The process involves crediting or debiting the daily obligation money in your trading account based on how the futures price behaves. The previous day closing price figure is considered to calculate the current day’s MTM. If the stock becomes highly volatile, then there is an increase in margin. The margin blocked by the broker at the time of initiating the futures trade is called the initial margin. Both the buyer and the seller of the futures agreement will have to deposit the initial margin amount.

Mark to Market (MTM) is calculated on daily basis at closing price of a contract. For example: If you buy ABC future contract @ Rs. 100 (2000 lot size)

|

Day 1 Closing |

103 |

+3 (profit) |

|

Day 2 Closing |

107 |

+4 (profit) |

|

Day 3 Closing |

102 |

-5 (loss) |

|

NET DIFFERENCE (PROFIT or LOSS) |

+2 (profit) |

What is a physical settlement

If on expiry, the trader does not close or rollover the future position, such a position would become liable for physical settlement. The trader will have to give or take delivery of this position to the extent of the lot size. In case of options, only in-the-money options are liable for physical settlement

Are brokerage charges applicable in case of physical settlement?

If the position is not squared off, the trader will be charged delivery brokerage

How is the brokerage charged on a contract that is physically settled?

If a trader doesn’t close such a position, he/she will be charged as per the brokerage rate charged for the equity segment by way of JV posting in the ledger. However, the same will not reflect on the contract note.

Which types of contracts get physically settled?

All the stocks under F&O get physically settled. However, Index contracts are not part of the physical settlement.

What are the Important Terminologies used in the market?

WRT Futures:

Spot Price: The price at which an underlying asset trades in the spot market.

Futures Price: The price at which the futures contract trades in the futures market

Expiry Date: The last date on which the contract will be traded, at the end of which the contract will cease to exist (Last Thursday of the month in Equity derivative in India)

Contract Size: The number of shares that has to be delivered under one contract. For instance, contract size of Nifty futures is 75.

WRT Options:

Option Price: It is the price which the option buyer pays to the option seller. It is also referred to as the 'option premium'

Strike Price: It is the predetermined price at which a specific derivative contract can be bought or sold

Expiration Date & Lot size: Options have the same expiry date and lot size as of the futures contract

Intrinsic Value: It is the difference between the strike price and spot price

Time Value (Theta): It is the rate of decline in the value of an option over time

In The Money (ITM): Indicates that an option has intrinsic value,

- ITM Call option = Strike price < Spot price

- ITM Put option = Strike > Spot price

Out of The Money (OTM): Indicates that an option does not have intrinsic value

- OTM Call option = Strike price > Spot price

- OTM Put option = Strike price < Spot price

At The Money (ATM): An option is said to be ATM when strike price = spot price.

What does MPP stand for?

MPP stands for Market Price Protection. It's a safety feature for your market orders.

What is the main goal of MPP?

To prevent slippage (buying too high or selling too low) in fast-moving or illiquid contracts, especially options.

newsletter

HSL Mobile App

HSL Mobile App