Corporate actions are events initiated by issuer of securitiesthat directly or indirectly affects its shareholders or bondholdersInvestors need to understand the impact of corporate actions to get their investment strategy right.

In this video, we will explain some of the prominent corporate actions

Bonus stock awarded to a company’s shareholders is called a bonus issue.

These are typically allotted in ratios corresponding to each shareholder' holding.

1:1, 2:1, 5:1 etc.

It’s important to note though – that only the number of shares held increases. The value of the holding remains the same.

Another type of Corporate Action often talked about is the Dividend.

A dividend is a portion of the profits, or excess cash reserves, that the company gives to its shareholders.

It is usually a percentage of the face value of each share.

So, a 25% dividend on a share of face value Rs. 100 will be Rs. 25.

Now, to the RIGHTS ISSUE

In a rights issue, fresh shares are issued by a company to its existing shareholders – but at a discounted price. For example, a 1:3 rights issue means an existing shareholder can opt to buy 1 share for every 3 shares held, at a lower price than the face value.

STOCK SPLITs encourage a wider retail participation by outing more shares into circulation

When a stock split is announced, the number of shares held increases. But the value of your investment remains the same.

Understanding the effects of corporate action helps investor in making better buying and selling decisions.

Know More to Grow More

Investment in securities market are subject to market risks, read all the related documents carefully before investing

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

SEBI Registration No.: INZ000186937 (NSE, BSE, MSEI, MCX) |NSE Trading Member Code: 11094 | BSE Clearing Number: 393 | MSEI Trading Member Code: 30000 | MCX Member Code: 56015 | AMFI Reg No. ARN -13549, PFRDA: POP-11092018, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657, Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193. Investment Adviser: INA000011538. Registered Address: I Think Techno Campus, Building, B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai -400 042. Tel -022 30753400. Compliance Officer: Ms. Binkle R Oza. Ph: 022-3045 3600 Email: [email protected].

Disclaimer : HDFC Securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs, IPOs, E-Will & E-Tax in strategic distribution partnerships. Customers need to check products & features before investing since the contours of the product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures & Options are subject to market risk. Clients should read the Risk Disclosure Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not be dealt at Exchange platform.

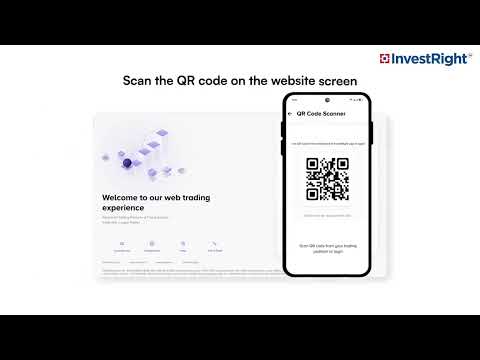

HSL Mobile App

HSL Mobile App