Let’s say you have a bag full of money

Now if you keep it at home, after 5 years you’ll still only have a bag of money

You can decide to put it in a bank and 5 years later you’ll probably have 2 bags of money

But if you invest this money, 5 years later you might have 5 bags of money or more!

Let’s understand why investing is beneficial

If you can buy a maha burger today with 100 rupees, next year you’ll be able to afford only a medium burger for the same amount

This is inflation. Inflation eats up the value of your money year on year.

So if you’re not beating inflation you are losing money.

Saving your money in a bank may just about beat inflation.

But if you invest your money, historical data proves you’ll outpace inflation and grow your wealth

Investing helps create wealth over time due to the power of compounding and helps you reach your financial goals such as buying a car, home, child’s education, your retirement and more.

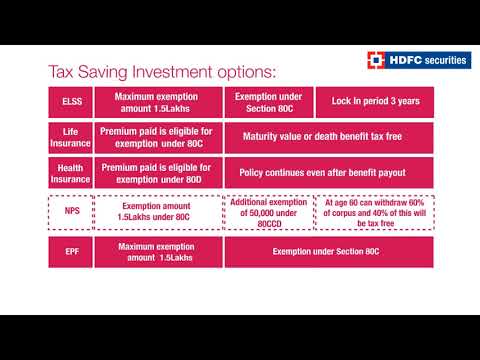

Investing is like giving your money a job, your money works for you and builds wealth. Plus some investments help reduce your taxable income indirectly growing wealth

The earlier you start, the more time you give your money to grow, the more wealth you create.

There are various investment options to cater to your risk appetite.

So choose your investment option wisely and start investing today.

Investment in securities market are subject to market risks, read all the related documents carefully before investing

SEBI Registration Nos.: INB011109437 (BSE -EQ) / INB231109431 (NSE-EQ) /INF231109431 (NSE -FO) / INF011109437 (BSE -FO)/ INE231109431 (NSE-CD) |NSE Member Trading Code: 11094 | BSE Clearing Number: 393 | AMFI Reg No. ARN -13549, PFRDA Reg. No - POP 04102015, IRDA Corporate Agent Licence No.-HDF2806925/HDF C000222657, Research Analyst Reg. No. INH000002475, CIN-U67120MH2000PLC152193. Registered Address: I Think Techno Campus, Building B, Alpha, Office Floor 8, Near Kanjurmarg Station, Kanjurmarg (East), Mumbai -400 042. Tel -022 30753400 Compliance Officer: Ms. Binkle R Oza. Ph: 022-30453600 Email: [email protected].

Disclaimer : HDFC securities Ltd is a financial services intermediary and is engaged as a distributor of financial products & services like Corporate FDs & Bonds, Insurance, MF, NPS, Real Estate services, Loans, NCDs & IPOs in strategic distribution partnerships. Customers need to check products & features before investing since the contours of the product rates may change from time to time. HDFC securities Ltd is not liable for any loss or damage of any kind arising out of investments in these products. Investments in Equity, Currency, Futures& Options are subject to market risk. Clients should read the Risk Disclosure. Document issued by SEBI & relevant exchanges & the T&C on www.hdfcsec.com before investing. Equity SIP is not an approved product of Exchange and any dispute related to this will not be dealt at Exchange platform.

HSL Mobile App

HSL Mobile App