Archean Chemical Industries Limited IPO

Archean Chemical Industries Limited is India's largest exporter of bromine and industrial salt in Fiscal 2021. The company is the leading speciality marine chemical manufacturer in India and is focused on producing and exporting bromine, industrial salt, and sulphate of potash to customers around the world.

Archean Chemical Industries markets theproducts to 18 global customers in 13 countries and to 24 domestic customers. The company was the largest exporter of industrial salt in India with exports of 2.7 million MT in Fiscal 2021.

Archean Chemical Industries Limited are the largest exporter of Bromine from India. The company is the only manufacturer of sulphate potash in India. The company's marine chemicals business is predominately conducted on a business-to-business basis both in India and internationally.

The company has an integrated production facility for the bromine, industrial salt, and sulphate of potash operations, located at Hajipir, Gujarat, located on the northern edge of the Rann of Kutch brine fields.

Objects of the Issue:

The Selling Shareholders will be entitled to their respective portion of the proceeds of the Offer for Sale.

The company proposes to utilise the Net Proceeds of the Fresh Issue towards funding the following objects:

- Redemption or earlier redemption, in part or full, of NCDs issued by the Company.

- General corporate purposes.

Strengths:

- Leading market position, expansion and growth in bromine and industrial salt.

- High entry barriers in the speciality marine chemicals industry.

- Established infrastructure and integrated production with cost efficiencies.

- Focus on environment and safety.

- Largest Indian exporter of bromine and industrial salt with a global customer base.

- Strong and consistent financial performance.

- Experienced management team, promoters and financial investors and stakeholders.

Company Promoters: Chemikas Speciality LLP, Ravi Pendurthi and Ranjit Pendurthi are the company promoters.

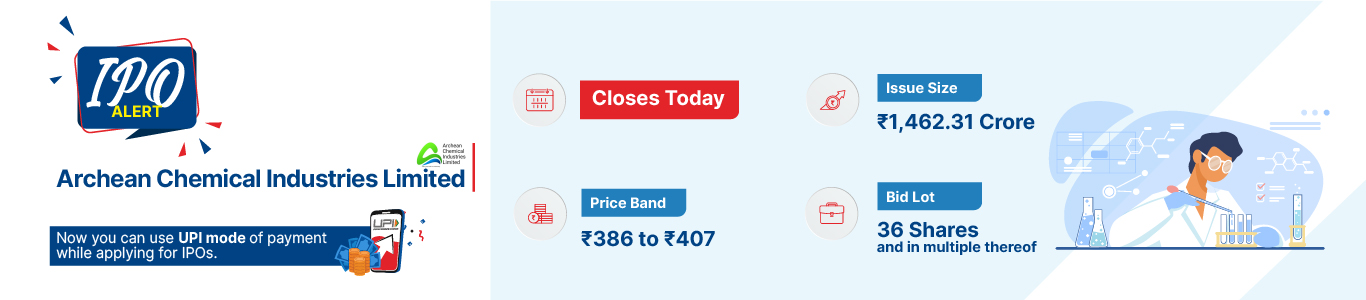

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in Crores) | |||

| Summary of financial Information | 31-Mar-19 | 31-Mar-20 | 31-Mar-22 | 31-Jun-22 |

| Total Assets | 1260.51 | 1428.6 | 1529.68 | 1606.65 |

| Total Revenue | 572.91 | 617 | 1142.83 | 408.82 |

| Profit After Tax | 39.97 | -36.24 | 188.58 | 84.41 |

| Total Worth | 42.37 | 5.97 | 261.06 | 345.44 |

| Total Borrowing | 772.02 | 929.26 | 921.87 | 915.58 |

HSL Mobile App

HSL Mobile App