Bajaj Finance Ltd

|

Company Overview:

To Download Application Forms :

-Resident Individual: Click Here |

Rate of interest (% per annum) valid for deposits up to `3 crore (w.e.f 10th June 2025)

Regular Depositors

| Regular FD: ` 15,000 to ` 3,00,00,000 | |||||

| Table 1 | |||||

| Period | Cumulative | Non-Cumulative | |||

| At Maturity | Monthly | Quarterly | Half Yearly | Annual | |

| (% p.a.) | (% p.a.) | (% p.a.) | (% p.a.) | (% p.a.) | |

| 12 - 14 months | 6.60 | 6.41 | 6.44 | 6.49 | 6.60 |

| 15 - 23 months | 6.75 | 6.55 | 6.59 | 6.64 | 6.75 |

| 24 - 60 months | 6.95 | 6.74 | 6.78 | 6.83 | 6.95 |

Senior Citizens

| Regular FD: ` 15,000 to ` 3,00,00,000 | |||||

| Table 2 | |||||

| Period | Cumulative | Non-Cumulative | |||

| At Maturity | Monthly | Quarterly | Half Yearly | Annual | |

| (% p.a.) | (% p.a.) | (% p.a.) | (% p.a.) | (% p.a.) | |

| 12 - 14 months | 6.95 | 7.74 | 7.78 | 6.83 | 6.95 |

| 15 - 23 months | 7.10 | 6.88 | 6.92 | 6.98 | 7.10 |

| 24 - 60 months | 7.30 | 7.07 | 7.11 | 7.17 | 7.30 |

*Cumulative Rate Compounded Annually

Rates above Rs.5 crore may vary from the published card rate # Minimum deposit size 25,000

Senior citizens (more than 60 years of age, subject to provision of proof of age) – Additional rate of 0.25% p.a. for deposit size up to Rs. 5 crore

Important points:

1. The number of tenor buckets have been increased from 3 to 9.

2. If a non-senior citizen invests for 15, 18 or 22 months, he will get rates mentioned in table 2. Apart from these 3 tenors, if he invests for any other tenor between 12 to 23 months, he will get rates mentioned in table 1. The same applies for other tenors.

3. For prematurities, rates only in tables 1 and 3 will apply. A line pertaining to this has been incorporated in T&Cs

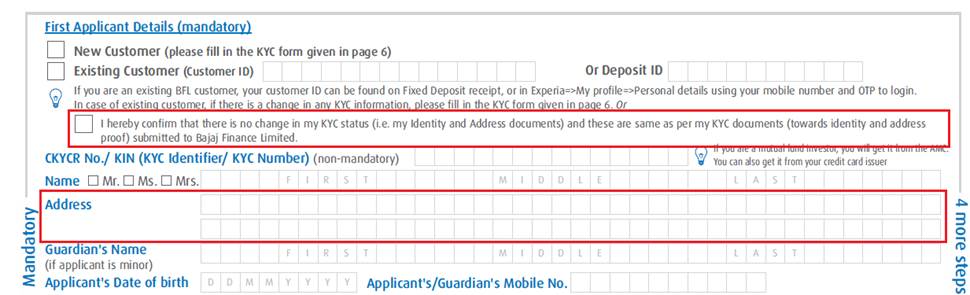

4. We have added a self-declaration box and address field in attached FD application form to cater to re-KYC needs. It is mandatory to fill the address field for each and every fresh and renewal case.

| If | Then | |

| Primary applicant is new customer | Self-declaration box is ticked | Address to be filled as per customer’s KYC documents. Also fill in KYC form. |

| Self-declaration box is not ticked | ||

| Primary applicant is existing customer | Self-declaration box is ticked | Address given in customer360 to be filled. No need to fill in KYC form |

| Self-declaration box is not ticked | Obtain customer’s updated KYC documents. Address to be filled as per customer’s KYC documents. Also fill in KYC form. |

HSL Mobile App

HSL Mobile App