ESAF Small Finance Bank Limited IPO

Incorporated in 1992, ESAF is a Small Finance Bank mainly focusing on providing loans to rural and semi-urban customers. The Bank's products consist of (a) Micro Loans, (b) retail loans, (c) MSME loans; (d) loans to financial institutions; and (e) agricultural loans. As of March 2023, Bank has a network of 700 outlets, 743 customer service centres, 20 business correspondents and 481 business facilitators. The Bank has 581 ATM's located across 21 states of India.

Bank offers convenience banking through various digital platforms such as an internet banking portal, a mobile banking platform, SMS alerts, bill payments and RuPay branded ATM cum debit cards.

As of 31st March 2022, the Bank has provided employment to 4100 people.

The core strength of the bank lies in the following:-

- In-depth knowledge of the Microloan segment helped ESAF to grow outside Kerela

- Strong presence in rural and semi-urban areas.

- Strong customer relationships driven by Bank's customer-centric products.

- Digital Technology platform for convenience banking.

Objects of the Issue (ESAF Small Finance Bank IPO Objectives)

The Net Proceeds are proposed to be utilized towards augmentation of the Bank's Tier-I capital base to meet the Bank's future capital requirements which are expected to arise out of growth in the Bank's assets, primarily the Bank's loans/advances and investment portfolio and to ensure compliance with regulatory requirements on capital adequacy prescribed by the RBI from time to time.

The Bank expects to receive the benefits of listing the Equity Shares on the Stock Exchanges.

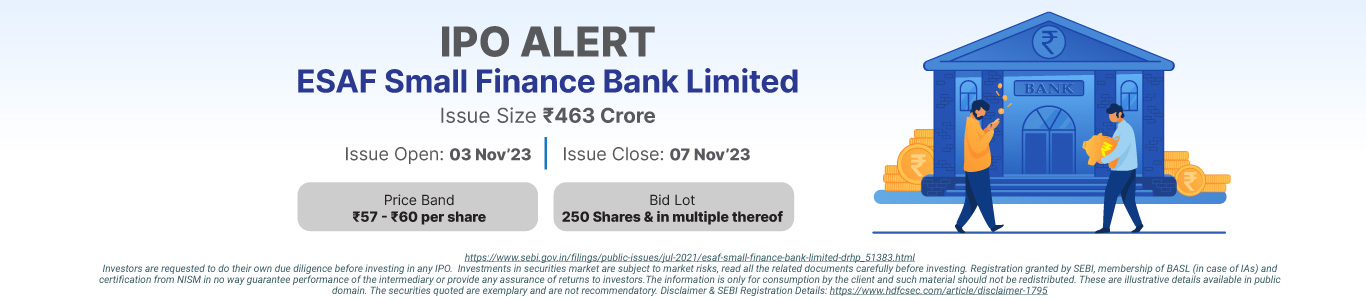

Issue Details

Company Financials

| Period Ended | 30-Jun-23 | 31-Mar-23 | 31-Mar-22 | 31-Mar-21 |

| Assets | 20,795.94 | 20,223.66 | 17,707.56 | 12,338.65 |

| Revenue | 991.78 | 3,141.57 | 2,147.51 | 1,768.42 |

| Profit After Tax | 129.96 | 302.33 | 54.73 | 105.4 |

| Net Worth | 1,839.09 | 1,709.13 | 1,406.80 | 1,352.06 |

| Reserves and Surplus | 1,389.62 | 1,259.66 | 957.32 | 902.59 |

| Total Borrowing | 2,739.13 | 3,354.20 | 2,952.83 | 1,694.00 |

HSL Mobile App

HSL Mobile App