Fusion Micro Finance Limited IPO

Fusion Micro Finance Ltd is engaged in providing financial services to women entrepreneurs belonging to the economically and socially deprived section of the society. The company's responsibilities are not restricted merely to financial support but also to acquaint the clients to manage their financials by disseminating Financial Literacy to them.

Fusion Micro Finance Ltd is one of the youngest companies among the top 10 NBFC-MFIs in India in terms of AUM as of June 30, 2022.

The company have achieved a significant footprint across India, where the company have extended its reach to 2.90 million active borrowers which were served through our network of 966 branches and 9,262 permanent employees spread across 377 districts in 19 states and union territories in India, as of June 30, 2022.

The company's business runs on a joint liability group-lending model, wherein a small number of women form a group (typically comprising five to seven members) and guarantee one another's loans.

As of June 30, 2022 and March 31, 2022, 2021 and 2020, our total AUM was Rs. 73,890.23 million, Rs. 67,859.71 million, Rs. 46,378.39 million and Rs. 36,065.24 million, respectively.

Objects of the Issue

The Selling Shareholders will be entitled to their respective portion of the proceeds of the Offer for Sale.

Objects of the Fresh Issue :

- Augment the capital base of the Company.

Competitive Strengths:

- Well Diversified and Extensive Pan-India Presence.

- Proven Execution Capabilities with Strong Rural Focus.

- Access to Diversified Sources of Capital and Effective Asset Liability Management.

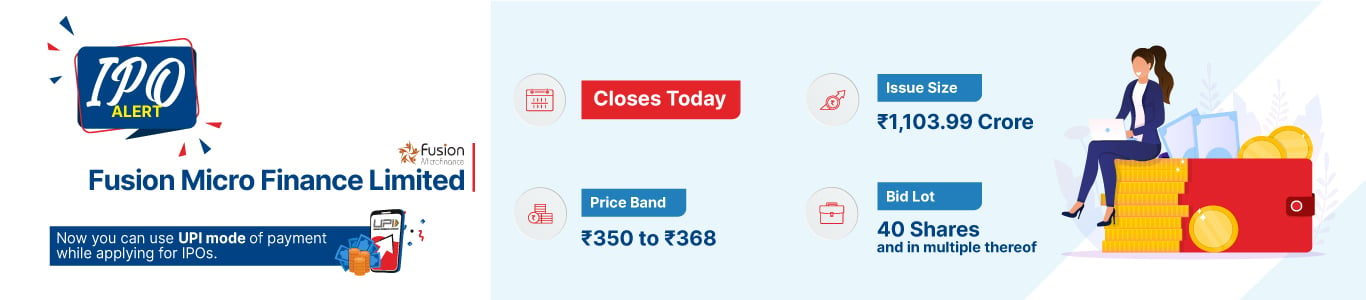

Issue details

Company Financials

| Particulars | For the year/period ended (₹ in Crores) | ||||

| Summary of financial Information | 31-Mar-20 | 31-Mar-21 | 31-Jun-21 | 31-Mar-22 | 31-Jun-22 |

| Total Assets | 4240 | 5837.9 | 5824.9 | 7290.5 | 7615.2 |

| Total Revenue | 730.31 | 873.09 | 264.96 | 1201.35 | 360.45 |

| Profit After Tax | 69.61 | 43.94 | 4.41 | 21.76 | 75.1 |

| Worth | 1198.9 | 1246.4 | 1251.7 | 1338 | 1416.5 |

| Total Borrowing | 2973.68 | 4432.25 | 4422.65 | 5775.81 | 6009.97 |

HSL Mobile App

HSL Mobile App