Global Health Limited IPO

Global Health Limited is one of the largest private multi-speciality tertiary care providers operating in the North and East regions of India. The company has key specialities in cardiology and cardiac science, neurosciences, oncology, digestive and hepatobiliary sciences, orthopaedics, liver transplant, and kidney and urology.

Global Health Limited have a network of four hospitals currently in operation (Gurugram, Indore, Ranchi and Lucknow) under the "Medanta" brand. The company established "The Medanta Institutional Tissue Repository" in 2017 to promote biomarker and other tissue-based research.

In Fiscals 2020, 2021 and 2022 and the three months ended June 30, 2021 and 2022, the company generated income from healthcare services of Rs. 14,805.71 million, Rs. 14,178.41 million, Rs. 21,003.95 million, Rs. 4,732.10 million and Rs. 5,960.89 226 million, respectively, and had EBITDA of Rs. 2,304.54 million, Rs. 2,228.52 million, Rs. 4,897.57 million, Rs. 1,057.69 million and Rs. 1,416.46 million, respectively.

As of June 30, 2022, the company provide healthcare services in over 30 medical specialities and engage over 1,300 doctors led by experienced department heads, spanning an area of 4.7 million sq. ft., the operational hospitals have 2,467 installed beds.

Global Health Limited's hospital at Gurugram was ranked as the best private hospital in India for three consecutive years in 2020, 2021 and 2022, and was the only Indian private hospital to be featured in the list of top 200 global hospitals in 2021 and was featured in the list of top 250 global hospitals in 2022 by Newsweek

Objects of the Issue:

The company proposes to utilize the net proceeds of the Fresh Issue towards funding of the following objects:

- Repayment/prepayment of borrowings, in full or part, of the Subsidiaries, GHPPL and MHPL.

- General corporate purposes.

Competitive Strengths:

- Leading tertiary and quaternary care provider in India, well recognised for clinical expertise in particular in dealing with complicated cases.

- Focus on Clinical Research and Academics.

- Large-scale hospitals with world-class infrastructure, high-end medical equipment, and technology.

- Track record of strong operational and financial performance.

- Focus on under-served areas with dense population and presence in top or capital cities of large states (NCR, Lucknow and Patna).

- Growth opportunities in existing facilities and diversification into new services, including digital health.

- Experienced senior management team with strong institutional shareholder support.

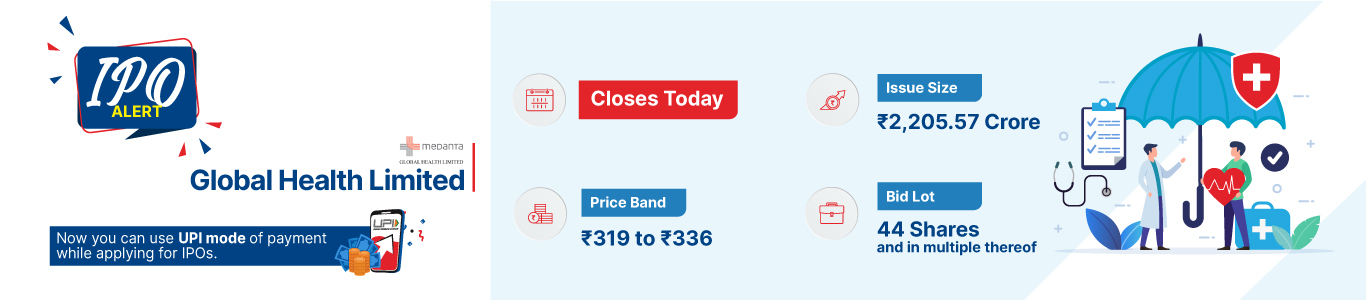

Issue detail

Company Financials

| Particulars | For the year/period ended (₹ in Crores) | ||||

| Summary of financial Information | 31-Mar-20 | 30-Jun-20 | 31-Mar-21 | 31-Mar-22 | 30-Jun-22 |

| Total Assets | 2666.29 | 2855.11 | 2694.1 |

3145.52 |

3221.94 |

| Total Revenue | 1544.27 |

491.58 |

1478.16 | 2205.82 | 626.54 |

| Profit After Tax | 36.33 | 41.76 | 28.8 | 196.2 | 58.71 |

| Total Worth | 1349.54 | 1425.38 | 1382.34 | 1616.01 | 1675.55 |

| Total Borrowing | 621.94 | 725.07 | 644.6 | 837.86 | 794.45 |

HSL Mobile App

HSL Mobile App