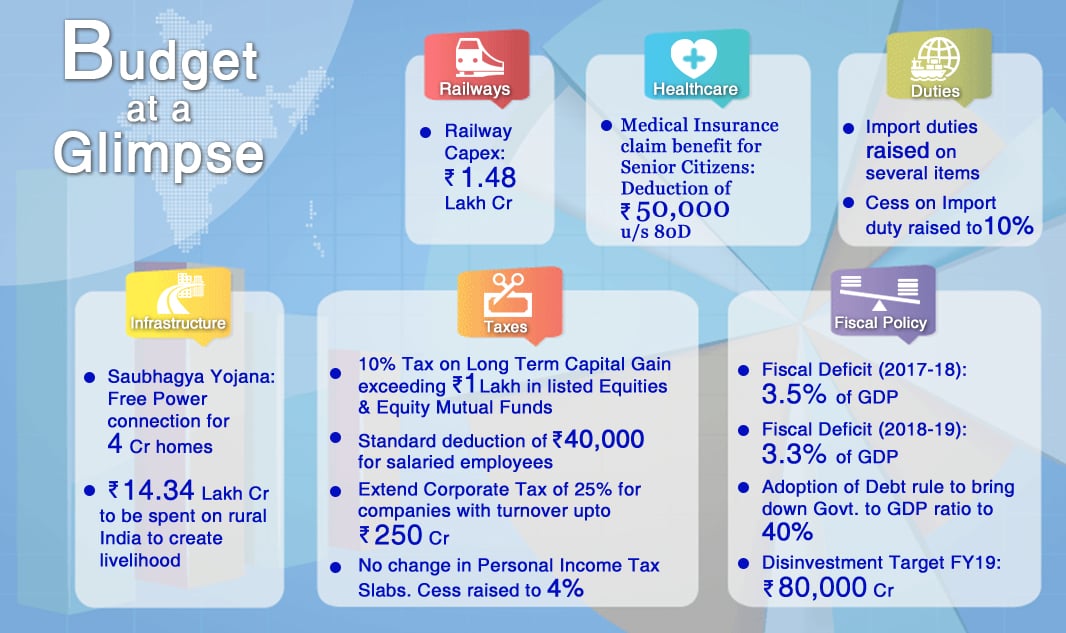

Union Budget 2018 - 19

On Feb 1, 2018 Union Budget was presented by the Finance Minister Arun Jaitley. A few highlights being - Long term capital gains tax exceeding Rs 1 lakh in listed Equities and Equity Mutual Fund at 10%, No changes in personal income tax slabs, fiscal deficit of 3.3% expected for 2018-19.

Below are the Top Highlights of this budget & our reseach expert views on this Budget.

Any LT Capital gains made on equities on Exchanges is exempt till 31st March 2018. The Govt has now proposed 10% LTCG tax on gains made above Rs 1 Lakh.

Since it is a Direct Tax proposal it will normally be applicable for the Assessment Year FY19-20 ( Financial Year FY18-19 ). In other words, the LT Capital gains, of over Rs 1 Lakh, made for the year FY18-19 will be liable to tax at 10%.

The FM has proposed grand fathering of LT Capital gains upto 31st Jan 2018. Any incremental LT Capital gains after that will be counted as LT Capital gains for the new tax.

HSL Mobile App

HSL Mobile App