Issue Details

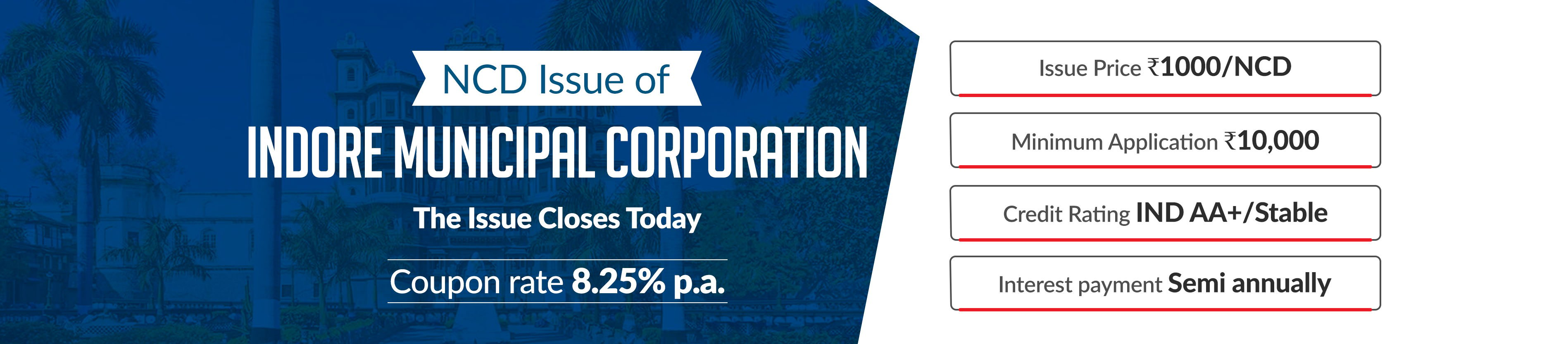

| Issue Open | Feb 10, 2023 - Feb 14, 2023 |

| Issuer | Indore Municipal Corporation's |

| Instrument | Secured Rated, Listed, Redeemable, Non-Convertible Debentures |

| Issue Size | Base Issue size of ₹ 244 Crore with an option to retain oversubscription up to ₹ 244 Crore |

| Issue Price | Face Value of INR 1,000/- per NCD consisting of 1 (one) STRPP A with face value of Rs. 250/-, 1 (one) STRPP B with face value of Rs. 250/- and 1 (one) STRPP C with face value of Rs. 250/-, 1 (one) STRPP C with face value of Rs. 250/-. |

| Face Value | ₹ 1,000/- per NCD. Each NCD shall comprise of 4 STRPPs having different ISINs and face value: (a)1 STRPP A of face value of ₹ 250; (b)1 STRPP B of face value of ₹ 250; (c)1 STRPP C of face value of ₹ 250; (d)1 STRPP D of face value of ₹ 250 |

| Minimum Application size | ₹ 10,000/- (10 NCDs comprising of 10 STRPP A, 10 STRPP B, 10 STRPP C,10 STRPP D) |

| Listing At | BSE, NSE |

| Credit Rating | “IND AA+/Stable’ & ‘CARE AA/Stable” by India Ratings & Research Pvt Ltd |

| Tenor | STRPP A of an NCD – 3 years, STRPP B of an NCD – 5 years, STRPP C of an NCD – 7 years, STRPP D of an NCD – 9 years |

| Payment Frequency | Half Yearly basis from the Deemed Date of Allotment |

| Issuance and Trading | Compulsorily in dematerialized form. |

| Basis of Allotment | First Come First Serve Basis |

| Put/Call Option | There is no put/call option for the NCDs |

ISSUE STRUCTURE

| ISSUE STRUCTURE | ||||

| Option/Series | STRPP A | STRPP B | STRPP C | STRPP D |

| Face Value / Issue Price of NCDs (₹ / NCDs) | 1 STRPP A of Face value of ₹ 250 | 1 STRPP B of Face value of ₹ 250 | 1 STRPP C of Face value of ₹ 250 | 1 STRPP C of Face value of ₹ 250 |

| Minimum Applications | 10,000 (10 NCDs comprising of 10 STRPP A, 10 STRPP B, 10 STRPP C,10 STRPP D) | |||

| STRPP with different ISIN# | STRPP A | STRPP B | STRPP C | STRPP D |

| Tenor | 3 Years | 5 Years | 7 Years | 9 Years |

| Coupon Rate (% p.a.) for All Categories | 8.25% p.a. payable Half Yearly | 8.25% p.a. payable Half Yearly | 8.25% p.a. payable Half Yearly | 8.25% p.a. payable Half Yearly |

| Effective Yield (% p.a.) for All Categories | 8.41% | 8.41% | 8.41% | 8.41% |

| Redemption Date/ Redemption Schedule | Staggered Redemption by Face Value for each respective STRPP as per "Principal Redemption Schedule and Redemption Amounts" | |||

| Maturity/Redemption (From the Deemed Date of Allotment) | 3 Years | 5 Years | 7 Years | 9 Years |

| *Of Deemed Date of Allotment | ||||

| *Upon allotment, an investor will be allotted all 4 STRPPs of an NCD against the equivalent amount invested by such an investor, subject to the minimum application size. | ||||

ALLOCATION RATIO

| Category | Institutional | Non Institutional | High Net worth Individual | Retail Individual Investor | |

| Category Allocation | 25% of the overall Issue Size | 25% of the overall Issue Size | 25% of the overall Issue Size | 25% of the overall Issue Size | |

| Bucket Size assuming Issue size of ₹ 244 Cr | ₹ 61 Cr | ₹ 61 Cr | ₹ 61 Cr | ₹ 61 Cr | |

Who can apply

| Category I | Category II | Category III | Category IV | |

|

|

|

|

|

APPLICATIONS CANNOT BE MADE BY

- Minors without a guardian name (A guardian may apply on behalf of a minor. However, the name of the guardian will need to be mentioned on the Application Form);

- Foreign nationals;

- Persons resident outside India;

- Foreign Institutional Investors;

- Non Resident Indians;

- Qualified Foreign Investors;

- Overseas Corporate Bodies;

- Foreign Venture Capital Funds;

- Persons ineligible to contract under applicable statutory/ regulatory requirements.

__title__

__answer__

__title__

__url__

HSL Mobile App

HSL Mobile App