Inox Green Energy Services Limited IPO

Incorporated in 2012, Inox Green Energy Services Limited is one of the major wind power operation and maintenance ("O&M") service providers within India. The company is a subsidiary of Inox Wind Limited ("IWL"), a company which is listed on the National Stock Exchange of India Limited and BSE Limited, and part of the Inox GFL group of companies.

Inox Green Energy services Limited provides exclusive O&M services for all WTGs sold by IWL through the entry of long-term O&M contracts between the WTG purchaser and ourselves for terms which typically range between five to 20 years.

The company is engaged in the business of providing long-term O&M services for wind farm projects, specifically the provision of O&M services for wind turbine generators ("WTGs").

As of March 31, 2022, the company has a team of 393 employees including managers with extensive experience in the O&M of WTGs and the wind industry generally.

The company has a presence in Gujarat, Rajasthan, Maharashtra, Madhya Pradesh, Karnataka, Andhra Pradesh, Kerela and Tamil Nadu.

The company's total revenue (from the continuing operations i.e. the O&M business) was Rs 1,721.66 million, Rs 1,722.48 million and Rs 1,653.15 million for Fiscals 2022, 2021 and 2020, respectively.

Objects of the Issue:

The net proceeds of the Fresh Issue, i.e., gross proceeds of the Fresh Issue:

- Repayment and/ or pre-payment, in full or part, of certain borrowings availed by the Company including redemption of Non- Convertible Debentures in full.

- General corporate purposes.

Strengths:

- Strong and diverse existing portfolio base.

- Established track record, favourable national policy support and visibility for future growth.

- Reliable cash flow supported by long-term O&M contracts with high credit quality counterparties.

- Supported and promoted by our parent company, IWL.

- Established supply chain in place.

- Strong and experienced management team.

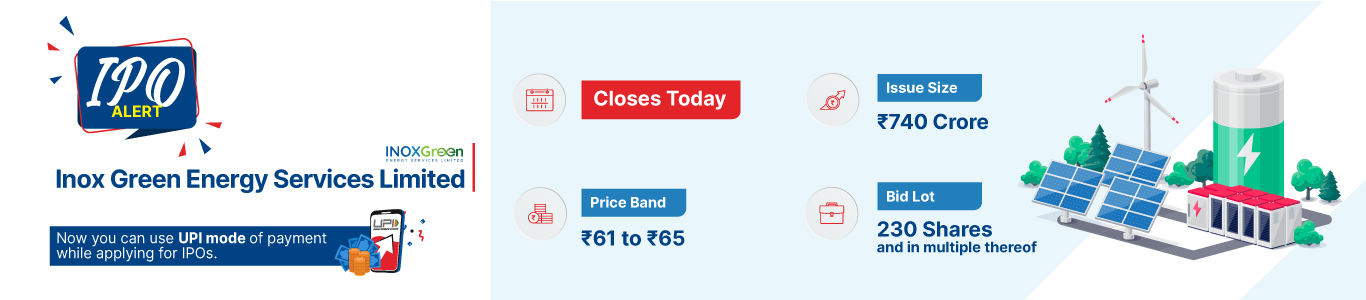

Issue Details

Company Financials

| Particulars | For the year/period ended (₹ in Crores) | |||

| Summary of financial Information | 31-Mar-20 | 31-Mar-21 | 31-Mar-22 | 30-Jun-22 |

| Total Assets | 2339.9 | 2692.8 | 2120.7 | 2127.7 |

| Total Revenue | 172.16 | 186.29 | 190.23 | 63.16 |

| Profit After Tax | 1.68 | -27.73 | -4.95 | -11.58 |

| Net Worth | 96.54 | 42.96 | 806.63 | 795 |

| Total Borrowing | 1084.92 | 1411.02 | 904.17 | 909.92 |

HSL Mobile App

HSL Mobile App