Landmark Cars Limited IPO

Incorporated in 1998, Landmark Cars Limited is the leading premium automotive retail business in India with dealerships for Mercedes-Benz, Honda, Jeep, Volkswagen and Renault. The company also cater to the commercial vehicle retail business of Ashok Leyland in India.

Landmark Cars offers services such as sales of new vehicles, after-sales service and repairs (including sales of spare parts, lubricants and accessories), sales of pre-owned passenger vehicles and facilitation of the sales of third-party finance and insurance products.

The company has expanded the network to include 112 outlets in 8 Indian states, comprised of 61 sales showrooms and outlets and 51 after-sales services and spare outlets, as of September 30, 2021.

Landmark Cars Limited vehicle dealership network is spread across 31 cities in eight states and union territories including Maharashtra, Uttar Pradesh, Gujarat, Haryana, Madhya Pradesh, Punjab, West Bengal and the National Capital Territory of Delhi.

The company operate as an authorized service centre for Mercedes-Benz, Honda, Volkswagen, Jeep, Renault and Ashok Leyland. Landmark Cars also provide after-sales service and repairs through 51 after-sales services and spare outlets, as of September 30, 2021.

The company's business model captures the entire customer value chain including retailing new vehicles, servicing and repairing vehicles, selling spare parts, lubricants and other products, selling pre-owned passenger vehicles and distribution of third-party finance and insurance products.

Objects of the Issue:

The Company proposes to utilise the Net Proceeds from the Fresh Issue towards funding the following objects:

- Repayment/pre-payment, in full or in part, of certain borrowings availed by the Company and Subsidiaries.

- General corporate purposes.

Company Promoter: Sanjay Karsandas Thakker is the company promoter.

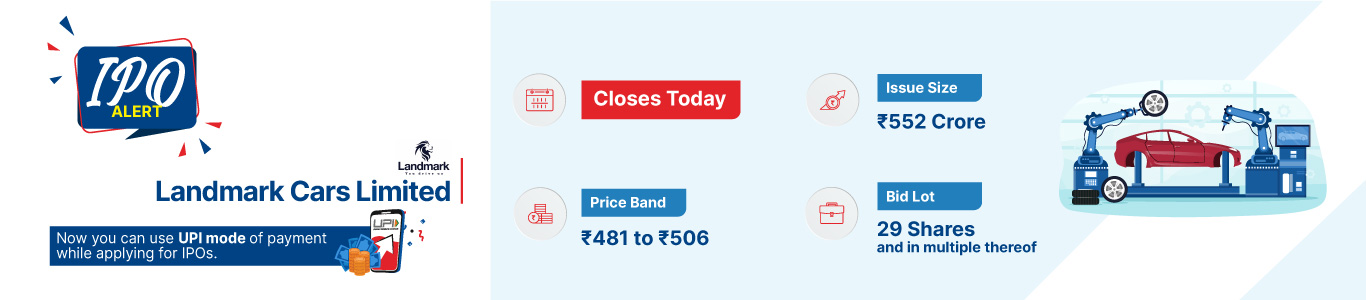

Issue details

Company Financials

| Particulars | For the year/period ended (₹ in Crores) |

||||

| Summary of financial Information | 31-Mar-19 | 31-Mar- 20 | 31-Mar-21 | 31-Mar-22 | 30-Jun-22 |

| Total Assets | 1008.03 | 831.77 | 887.9 | 1085.38 | 1209.37 |

| Total Revenue | 2834.62 | 2228.93 | 1966.34 | 2989.12 | 801.9 |

| Profit After Tax | -24.43 | -28.94 | 11.15 | 66.18 | 18.14 |

| Net Worth | 187.96 | 169.12 | 181.78 | 246.94 | 268.27 |

| Total Borrowing | 478.78 | 357.91 | 327.44 | 308.49 | 464.36 |

HSL Mobile App

HSL Mobile App