LIC IPO Objectives

- To address working capital requirements

- To boost the Indian stock market

- To ease Government’s disinvestment goals

- To accelerate the country’s equity value

The primary obligation through this investment of funds is to the policyholders whose money the corporation holds with utmost trust and aims to meet their reasonable expectations with regards to funds safety and assurance of optimal returns

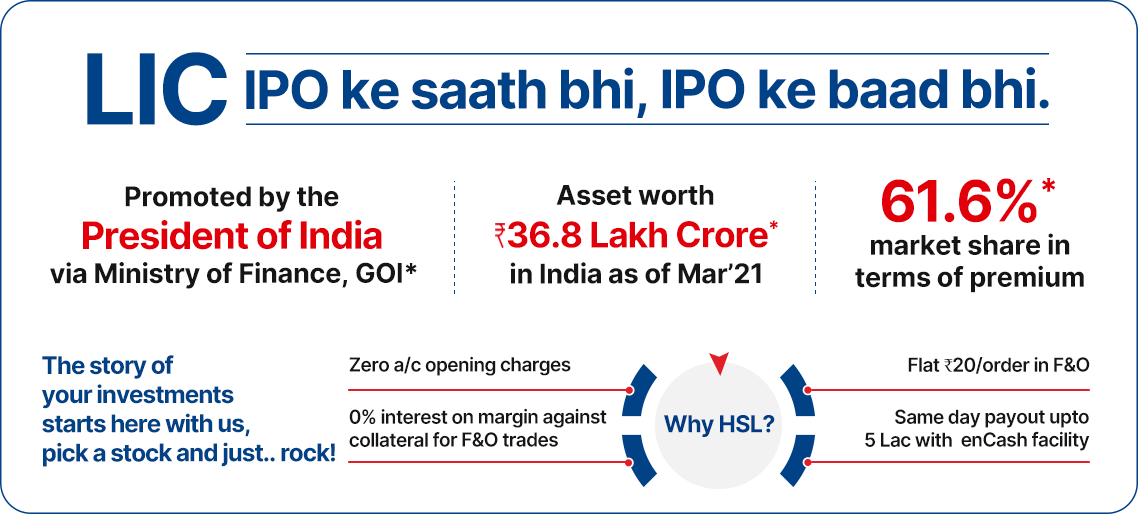

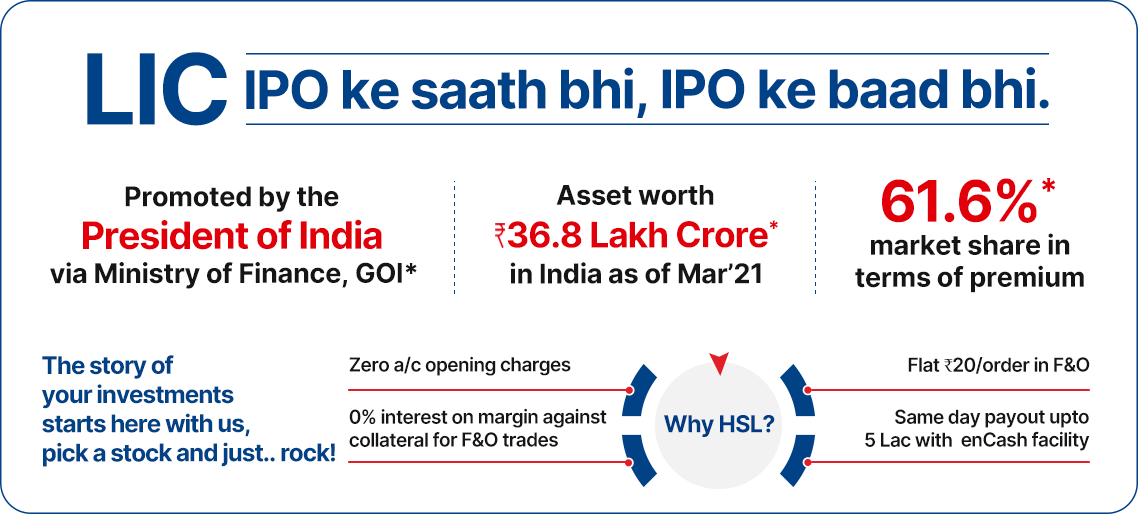

Why Apply on HSL?

Applying for LIC IPO via HDFC Securities Limited is a completely hassle-free process. You need to have a Demat account for that. If you don’t have one already, no worries as it is an online, paperless procedure and can be done in a matter of a few minutes. Plus, the account opening and maintenance charges are zero. Rest assured, you can apply online for LIC IPO effortlessly. Besides IPOs, there are multiple features and tools that ensure smooth sailing in your investment journey, each customized as per your individual needs and preferences. Expert assistance is also offered via ProTerminal - an advanced system designed for our privileged investors for an in-depth analysis of the market, helping them make accurate real-time trading decisions.

LIC IPO – Why is it a Big Buzz?

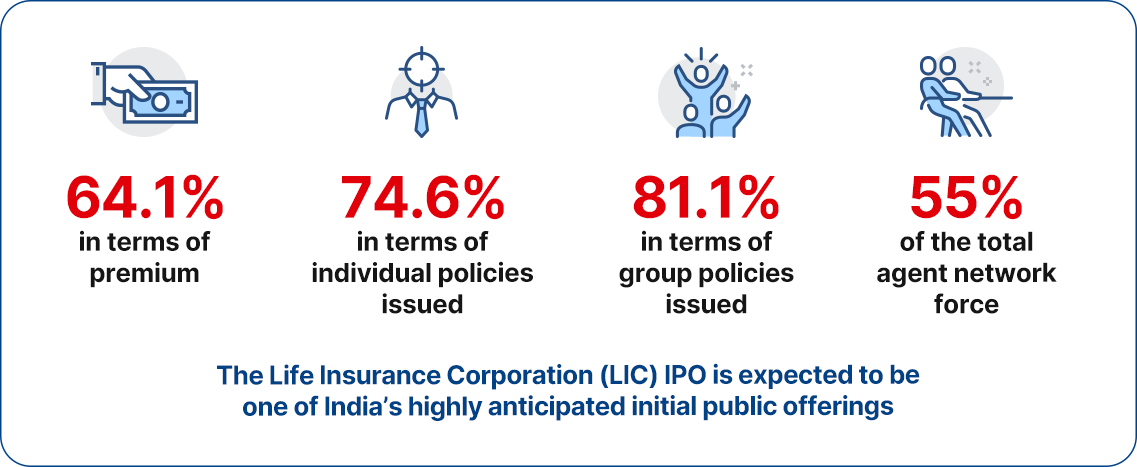

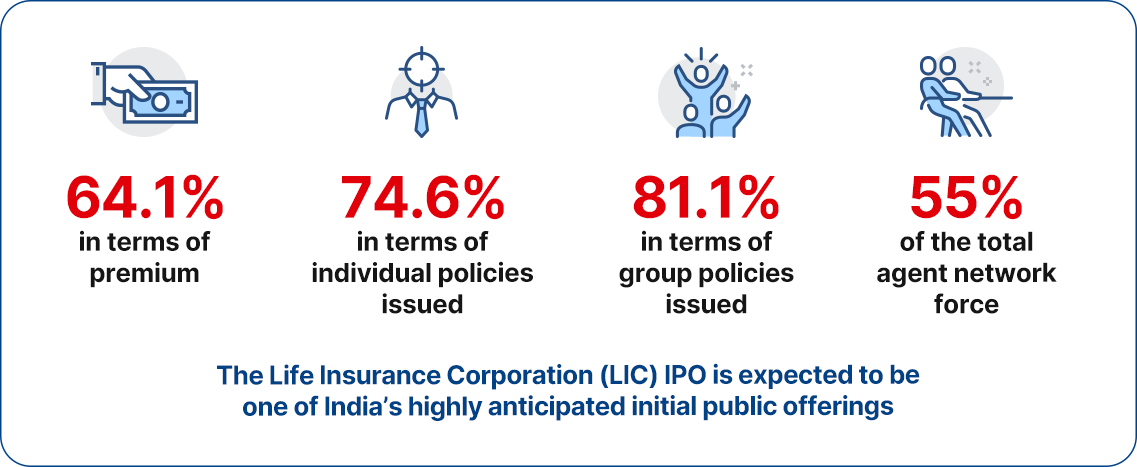

The Indian government intends to sell 3.5% of its stake in LIC for nearly INR 65,000 crores. Known for providing life insurance in India for over 65 years, it is the country's largest life insurer. LIC's dominance among peers is unrivalled globally, with no other life insurance company in any country having such a large market share in its geography. Among the peer group studied, it ranks fifth in terms of net premium earned.

Competitive Market Strength in India

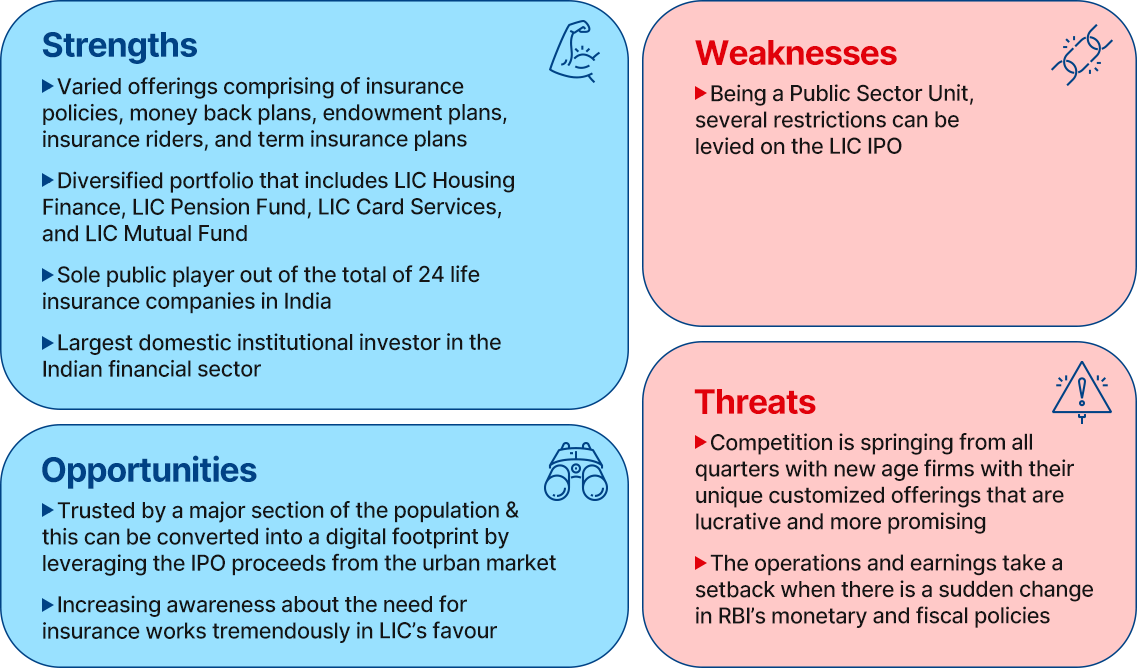

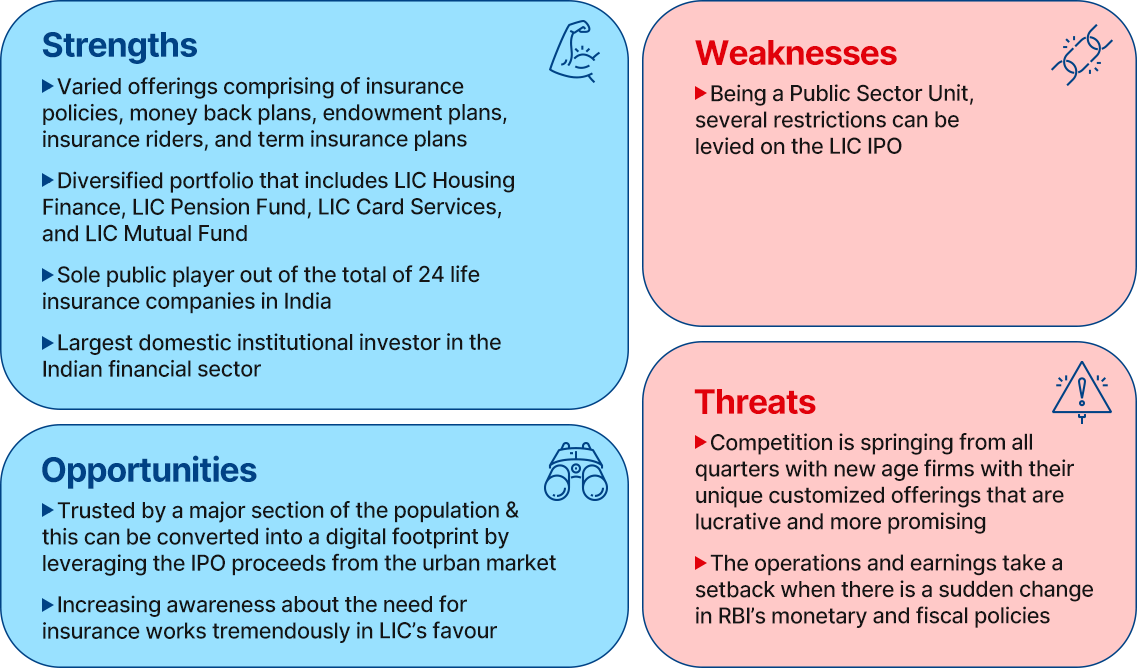

SWOT Analysis for LIC IPO

LIC IPO Updates & News

Ever since India’s largest life insurer announced its public offering, LIC IPO date and price became the most-anticipated aspects for the stock market. With the launch date revealed, investors are eagerly waiting to subscribe to perhaps the biggest IPO offering the country has seen.

In the latest developments, the Government of India has filed an updated draft red herring prospectus (DRHP) for the LIC upcoming IPO, and once the capital markets regulator Securities and Exchange Board of India (SEBI) approves it, the government aims to file red herring prospectus (RHP) for the life insurer’s public offering by end of April 2022.

While everyone has been keen to know about the price, the band is expected to be around Rs 940 per share, according to sources. Click here to open an Account.

HSL Mobile App

HSL Mobile App