| Issuer |

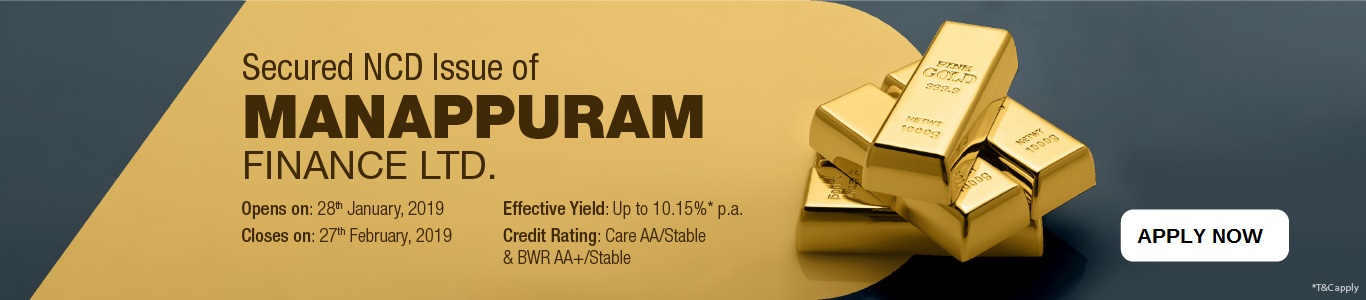

Manappuram Finance Limited |

Type of instrument/ Nature/ Name

of the security/ Seniority |

Secured, redeemable, non-convertible debentures |

| Issue Size |

Public issue by the Company of secured, redeemable, non-convertible debentures of face value of Rs.1,000 each for an amount aggregating up to Rs.1,000 crores |

| Issue opening date |

Monday , 28th January 2019 |

| Issue closing date** |

Wednesday , 27th February 2019 |

| Allotment |

Compulsorily in dematerialised form |

| Face value |

Rs 1,000 per NCD |

| Issue Price |

Rs 1,000 per NCD |

| Minimum Application size and in multiples of NCD thereafter |

Rs.10,000 (10 NCDs) collectively across all Series and in multiples of Rs.1,000 (1 NCD) thereafter across all Series |

| Listing |

The NCDs are proposed to be listed on BSE. BSE shall be the Designated Stock Exchange for the Issue. The NCDs shall be listed within six Working Days from the Tranche II Issue Closing Date. |

| Rating |

| Rating agency |

Instrument |

Rating symbol |

Date of credit rating letter |

|

Brickwork Ratings

India Private Limited

|

Secured, redeemable nonconvertible

debentures |

‘BWR

AA+’/Stable |

August 29, 2018, revalidated by letter dated October 11, 2018 and further revalidated by letters dated December 24, 2018 and January 21, 2019 |

CARE Ratings

Limited |

Secured, redeemable nonconvertible

debentures |

‘CARE AA’/

Stable |

August 20, 2018, revalidated on September 17, 2018 and further revalidated by letters dated October 8, 2018, December 26, 2018 and January 21, 2019 |

|

| Security and Asset Cover |

The principal amount of the Secured NCDs to be issued in terms of the Draft Shelf Prospectus, this Shelf Prospectus and/or the relevant Tranche Prospectus(es) together with all interest due and payable on the Secured NCDs, thereof shall be secured by way of first pari passu charge in favour of the Debenture Trustee on an identified immovable property and first pari passu charge on receivables of the Company, both present and future, book debts, loans and advances and current assets of the Company, created in favour of the Debenture Trustee, as specifically set out in and fully described in the Debenture Trust Deed, except those receivables present and/or future specifically and exclusively charged in favour of certain existing charge holders, such that a security cover of 100% of the outstanding principal amounts of the Secured NCDs and interest thereon is maintained at all time until the Maturity Date. |

Click Here to Invest in Manappuram Finance NCD

| Series |

I |

II |

III |

IV |

V |

VI |

VII |

| Frequency of Interest Payment |

Monthly |

Monthly |

Annual |

Annual |

NA |

NA |

NA |

| Tenor |

36 months |

60 months |

36 months |

60 months |

36 months |

60 months |

2,617 days |

| Coupon (%) for all Investor categories * |

9.35% |

9.75% |

9.75% |

10.15% |

NA |

NA |

NA |

Effective Yield (per annum) (Approx.) for all Investor

categories * |

9.75% |

10.19% |

9.74% |

10.14% |

9.75% |

10.15% |

10.15% |

| Redemption amount (Rs. per NCD) |

1,000.00 |

1,000.00 |

1,000.00 |

1,000.00 |

1,322.30 |

1,622.38 |

2,000.00 |

Redemption Date (Years from the Deemed Date of

Allotment) |

36 months |

60 months |

36 months |

60 months |

36 months |

60 months |

2,617 days |

| Minimum Application and in multiples thereafter |

Rs. 10,000 (10 NCDs) collectively across all Series and in multiples of Rs. 1,000 (1 NCD)

thereafter |

| Interest type |

Fixed |

| Put and call option |

NA |

| Mode of Interest Payment |

Through various options available |

HSL Mobile App

HSL Mobile App