| Issue Open |

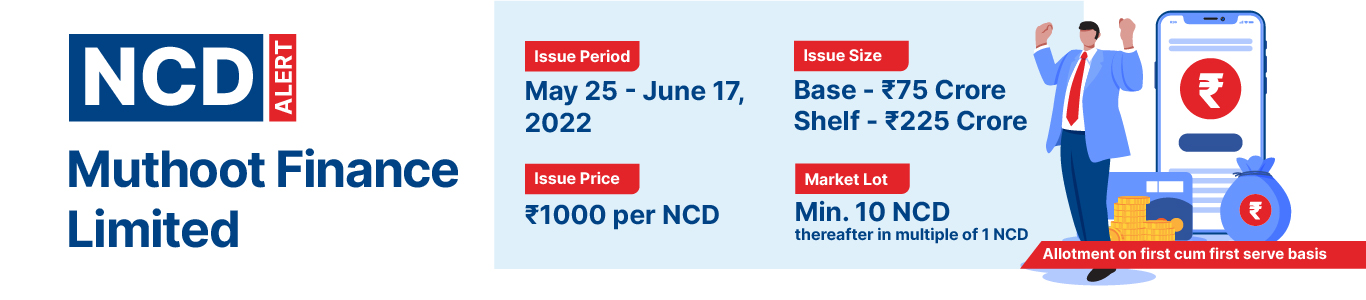

May 25, 2022 - Jun 17, 2022 |

| Security Name |

Muthoot Finance Limited |

| Security Type |

Secured, Redeemable, Non-Convertible Debentures (Secured NCDs) |

| Issue Size (Base) |

Rs 75.00 Crores |

| Issue Size (Shelf) |

Rs 225.00 Crores |

| Issue Price |

Rs 1000 per NCD |

| Face Value |

Rs 1000 each NCD |

| Minimum Lot size |

10 NCD |

| Market Lot |

1NCD |

| Listing At |

BSE |

| Credit Rating |

ICRA AA+/Stable |

| Tenor |

36, 60 and 84 months |

| Series |

Series I to VII |

| Payment Frequency |

Monthly and Annually |

| Basis of Allotment |

First Come First Serve Basis |

| |

Series 1 |

Series 2 |

Series 3 |

Series 4 |

Series 5 |

Series 6 |

Series 7 |

| Frequency of Interest Payment |

Monthly |

Monthly |

Annual |

Annual |

Annual |

NA |

NA |

| Nature |

Secured |

|

|

|

|

|

|

| Tenor |

36 months |

60 months |

36 months |

60 months |

84 months |

36 months |

60 months |

| Coupon Rate (Retail) |

7.25% |

7.50% |

7.50% |

7.75% |

8.00% |

NA |

NA |

| Effective Yield (% per Annum) |

7.25% |

7.50% |

7.50% |

7.75% |

8.00% |

7.50% |

7.75% |

| Amount on Maturity |

Rs 1,000 |

Rs 1,000 |

Rs 1,000 |

Rs 1,000 |

Rs 1,000 |

Rs 1,242.30 |

Rs 1,452.40

|

NCD Rating : The NCDs proposed to be issued under the Issue have been rated [ICRA] AA+/Stable by ICRA Limited such ratings are considered to have a stable outlook.

Company Promoters : George Thomas Muthoot, George Jacob Muthoot and George Alexander Muthoot are the company promoters.

Objects of the Issue

- The Net Proceeds raised through this Tranche I Issue will be utilised for following activities:

- Lending purposes.

- General corporate purposes.

| Category |

NCD's Allocated |

| Institutional |

5% |

| Non-Institutional |

5% |

| HNI |

40% |

| Retail |

50% |

HSL Mobile App

HSL Mobile App