Paras Defence And Space Technologies Limited IPO

Paras Defence and Space Technologies are primarily engaged in the designing, developing, manufacturing, and testing of a variety of defence and space engineering products and solutions. The company has five major product category offerings - Defence & Space Optics, Defence Electronics, Heavy Engineering, Electromagnetic Pulse Protection Solutions, and Niche Technologies. Paras Defence and Space Technologies is the only Indian company with the design capability for space-optics and opto-mechanical assemblies and is one of the leading providers of optics for various Indian defence and space programs. The company also delivers customized turnkey projects in the defence segment. The company has partnered with some of the leading technology companies around the world to indigenize advanced technologies in the defence and space sectors for the Indian market.

The company has 2 manufacturing plants in Maharashtra and is in the process of expanding its current manufacturing facility at Nerul in Navi Mumbai.

Competitive Strengths:

- Wide range of products and solutions offerings for defence and space applications.

- One of the few manufacturers of optics for space and defence application in India.

- Companies offerings are aligned with the “Atmanirbhar Bharat” and “Make in India” initiatives by the government.

- Strong R&D capabilities with a focus on innovation.

- Strong customer relationship with government arms and government organizations.

- Strong experienced management.

Company Promoters:

Sharad Virji Shah and Munjal Sharad Shah are the company promoters.

Company Financials

| Particulars | For the year/period ended (₹ in millions) | ||

| Summary of financial Information (Restated Consolidated) | 31-Mar-21 | 31-Mar-20 | 31-Mar-19 |

| Total Assets | 3,627.58 | 3,423.86 | 3,297.48 |

| Total Revenue | 1,446.07 | 1,490.51 | 1,571.69 |

| Profit After Tax | 157.86 | 196.57 | 189.7 |

Objects of the Issue:

- Fund capital expenditure requirements.

- Funding incremental working capital requirements.

- Repayment or prepayment of all or a portion of certain borrowings/outstanding loan facilities availed by the company.

- General Corporate purposes.

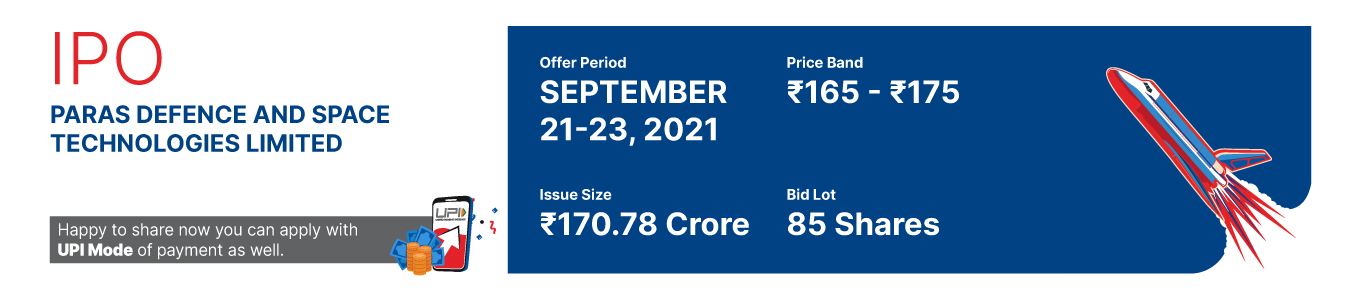

Issue Details

HSL Mobile App

HSL Mobile App