Cash Order

Cash Trading is the most common form of share trading. It is also commonly known as delivery-based trading, since the stocks are deposited in the trading account of the investor.

The biggest advantage of cash trading is that you are not constrained by any time limit to buy/sell stocks, unlike margin trading or derivative trading. Under cash trading, you can buy and hold on to the stocks for as much time as you want to. You have the flexibility to wait until you get the desired profit.

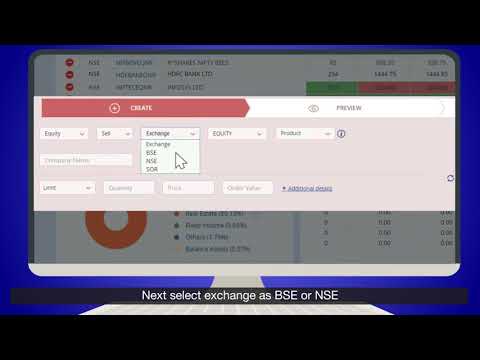

HSL Mobile App

HSL Mobile App