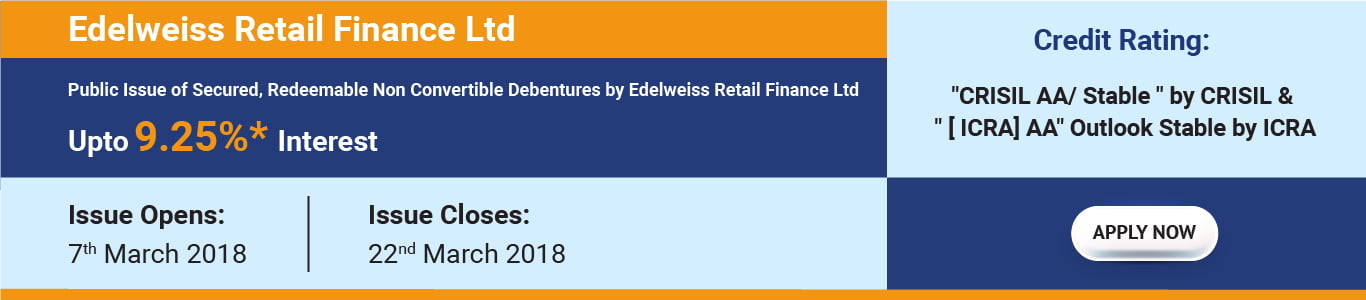

Edelweiss Retail Finance Limited NCD

| Issuer | Edelweiss Retail Finance Limited |

| Issue Size | Rs 500 Crore |

| Issue | Public Issue by the Company of 25,00,000 NCDs of face value of ₹1,000 aggregating up to ₹ 250 Crores with an option to retain over-subscription up to additional 25,00,000 NCDs amounting to ₹ 250 Crores aggregating up to ₹ 500 Crores, on the terms and in the manner set forth herein. |

| Rating | “CRISIL AA/Stable” and “[ICRA]AA” |

| Issue opens |

Wednesday, 7th March 2018 |

| Issue closes | Thursday, 22nd March 2018 |

| Issue Price | ₹ 1,000 per NCD |

| Minimum Application | ₹ 10,000 (10 NCDs) and in multiple of ₹1,000 (1 NCD) thereafter |

| Listing | The NCDs are proposed to be listed on BSE and NSE, within 12 Working Days from the Issue Closing Date. |

SPECIFIC TERMS FOR EACH SERIES OF NCDs

| Series | I | II | III | IV*** | V | VI |

| Frequency of interest Payment | Monthly | Annual | Monthly | Annual | Monthly | Annual |

| Minimum Application | Rs. 10,000/- (10 NCD) across all series collectively | |||||

| Nature of Instruments | Secured | Secured | Secured | |||

| Tenor from Deemed Date of Allotment | 3 Years | 3 Years | 5 years | 5 years | 10 years | 10 years |

| Coupon (% per annum) for NCD Holders in Category I, II, III & Category IV | 8.42% | 8.75% | 8.65% | 9.00% | 8.88% | 9.25% |

| Effective Yield (per annum) for NCD Holders in Category I, II, III and Category IV | 8.75% | 8.75% | 9.00% | 9.00% | 9.25% | 9.25% |

| Mode of Interest payment | Through various mode available | |||||

| Amount (Rs/ NCD) on Maturity for NCD Holders in Category I, II, III & Category IV | Rs.1000/- | Rs.1000/- | Rs.1000/- | Rs.1000/- | Rs.1000/- | Rs.1000/- |

|

Maturity Date (from Deemed Date of Allotment) |

3 years | 5 years | 10 years | |||

*** The Company shall allocate and allot Series IV NCDs wherein the Applicants have not indicated their choice of the relevant NCD series.

COMPANY PROFILE

· Edelweiss Retail Finance Limited (“Company” or “ERFL”), incorporated on Feb 18, 1997, is a RBI registered NBFC ND-SI

· ERFL is a NBFC belonging to Edelweiss Group – one of India’s prominent financial services organizations having businesses organized around three broad lines – credit including retail finance; franchise & advisory businesses including wealth management, asset management, capital markets, balance sheet management and others, and insurance business.

· Edelweiss Group has a pan India presence with a global footprint extending across geographies with offices in New York, Mauritius, Dubai, Singapore, Hong Kong and UK. EFSL is listed on BSE and National Stock Exchange of India Limited

· Notified as “Public Finance Institution” status by the MCA, under section 4A of Companies Act, 1956 (now Section 2(72) of the Companies Act, 2013).

- Products include SME Finance, Loans against property, Construction Finance & Rural Finance.

How To Invest in NCD's:

|

|

HSL Mobile App

HSL Mobile App