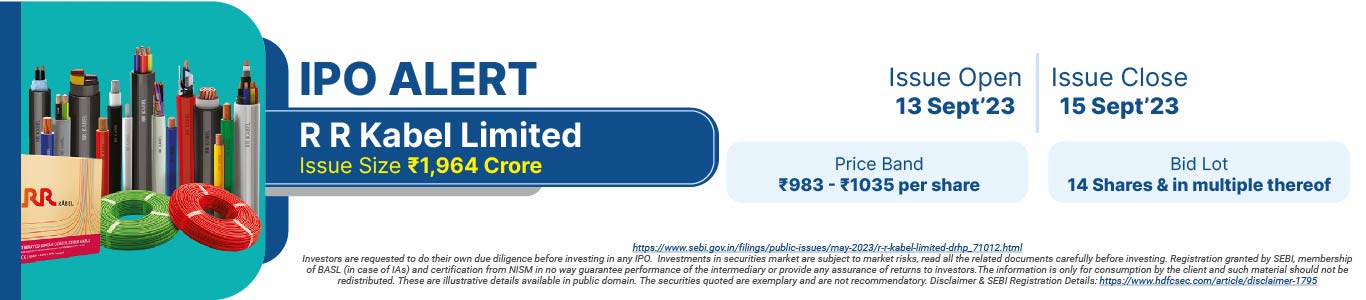

R R Kabel Limited IPO : Issue opens on 13th September 2023.

Incorporated in 1995, R R Kabel Limited provides consumer electrical products used for residential, commercial, industrial, and infrastructure purposes.

R R Kabel has two broad segments:

1. Wires and cables including house wires, industrial wires, power cables, and special cables; and

2. FMEG including fans, lighting, switches, and appliances.

The company undertakes the manufacturing, marketing, and sale of wires and cable products under 'RR Kabel' brand, and fans and lights under the 'Luminous Fans and Lights' brand.

In 2020, R R Kabel acquired Arraystorm Lighting Private Limited and obtained light emitting diode (LED) lights and related hardware business (LED Lights Business) along with its trademarks and design certificates, to expand their portfolio to cover office, industrial, and warehouse spaces. In 2022, the company acquired the home electrical business (HEB) of Luminous Power Technologies Private Limited, and obtained a limited and exclusive license to use the Luminous Fans and Lights brand for fan and light products for a maximum period of four years with a one-time option to further renew the license for a period of three months and, that includes a right to use 61 registered trademarks, and a portfolio of lights and premium fans, to strengthen our FMEG portfolio.

The company has two manufacturing units located at Waghodia, Gujarat, and Silvassa, Dadra and Nagar Haveli, and Daman and Diu which primarily carry out manufacturing operations of wire and cables and switches. Apart from that, it owns and operates three integrated manufacturing facilities which are located at Roorkee, Uttarakhand; Bengaluru, Karnataka; and Gagret, Himachal Pradesh, which carry out manufacturing operations in respect of FMEG products.

R R Kabel's clientele comes from both the domestic market and international markets. In the last three months ending June 30, 2023, 71% of its revenue from operations came from the wires and cables segment; and 97% of the revenue from operations came from the FMEG segment, from the B2C channel.

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

1. Repayment or prepayment, in full or in part, of borrowings availed by the company from banks and financial institutions.

2. General corporate purposes

Company Promoters:

Tribhuvanprasad Rameshwarlal Kabra, Shreegopal Rameshwarlal Kabra, Mahendrakumar Rameshwarlal Kabra, Kirtidevi Shreegopal Kabra, Tribhuvanprasad Kabra HUF, Kabra Shreegopal Rameshwarlal HUF and Mahendra Kumar Kabra HUF are the promoters of the company.

Issue Details

Company Financials

R R Kabel IPO Financial Information (Restated Consolidated)

| Period Ended | 31-Mar-20 | 31-Mar-21 | 31-Mar-22 | 31-Mar-23 |

| Assets | 1,545.36 | 1,715.11 | 2,050.64 | 2,633.62 |

| Revenue | 2,505.54 | 2,745.94 | 4,432.22 | 5,633.64 |

| Profit After Tax | 122.4 | 135.4 | 213.94 | 189.87 |

| Net Worth | 875.07 | 1,033.38 | 1,237.05 | 1,390.47 |

| Reserves and Surplus | 459.23 | 594.93 | 781.31 | 914.15 |

| Total Borrowing | 395.29 | 498.71 | 521.11 | 515.84 |

Amount in ₹ Crore

HSL Mobile App

HSL Mobile App