Rishabh Instruments Limited

Incorporated in 1982, Rishabh Instruments Limited is engaged in the business of manufacturing, design, and development of Test and Measuring Instruments and Industrial Control Products.

The company provides cost-effective solutions to measure, control, record, analyze, and optimize energy and processes through an array of products. It also provides complete aluminum high-pressure die-casting solutions for customers requiring close tolerance fabrication (such as automotive compressor manufacturers and automation high precision flow meters manufacturers), machining, and finishing of precision components.

In 2011, Rishabh Instruments acquired Lumel Alucast, a non-ferrous pressure casting company in Europe, which helped the company establish a strong foot in manufacturing and supply of low-voltage current transformers. The company also provides certain manufacturing services which include mould design and manufacturing, EMI/EMC testing services, Electronic Manufacturing Services, and software solutions (e.g., MARC).

Rishabh Instruments has 4 segments: (a) electrical automation devices; (b) metering, control, and protection devices; (c) portable test and measuring instruments; and (d) solar string inverters.

The company has 3 manufacturing units and more than 270 dealers across the globe, reaching 70+ countries and 150+ dealers across India covering every state.

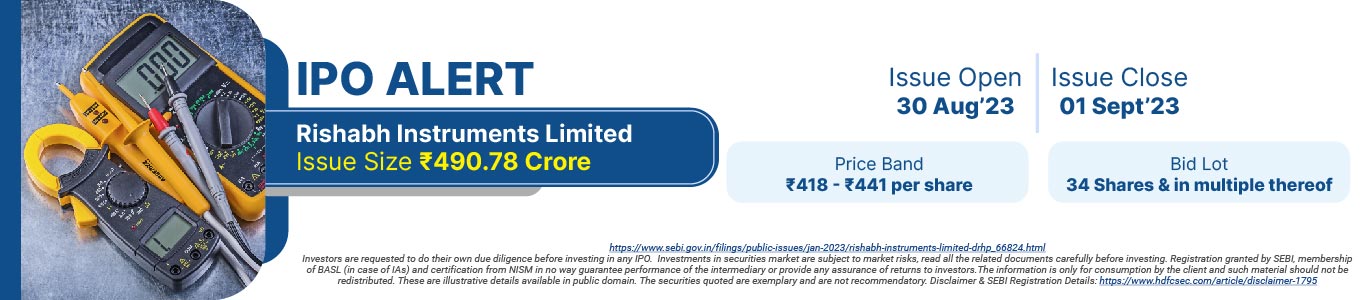

Rishabh Instruments IPO Details

Rishabh Instruments IPO is a Book Built Issue. The IPO total issue size is Rs 490.78 Cr. The Rishabh Instruments IPO price is ₹418 to ₹441 per share. The IPO will list on BSE, NSE.

Objects of the Issue

The company intends to utilize the net proceeds from the issue towards the funding of the following objects:

- Financing the cost towards the expansion of Nashik Manufacturing Facility I, and

- General corporate purposes.

Issue Details

Company Financials

| Period Ended | 31-Mar-21 | 31-Mar-22 | 31-Mar-23 |

| Assets | 511.97 | 563.89 | 648.93 |

| Revenue | 402.49 | 479.92 | 579.78 |

| Profit After Tax | 35.94 | 49.65 | 49.69 |

| Net Worth | 302.13 | 346.1 | 408.75 |

| Reserves and Surplus | |||

| Total Borrowing | 91.95 | 96.57 | 102.85 |

HSL Mobile App

HSL Mobile App