SBFC Finance Limited

Incorporated in 2008, SBFC Finance Limited is a systemically important, non-deposit-taking Non-Banking Finance Company (NBFC-ND-SI). The primary customer base of the company includes entrepreneurs, small business owners, self-employed individuals, and salaried and working-class individuals.

SBFC provides its services in the form of Secured MSME Loans and Loans against Gold.

SBFC Finance tends to extend its services to entrepreneurs and small business owners who are underserved or unserved by traditional financial institutions like banks. There are various factors taken into consideration while offering financial assistance in the form of loans. SBFC Finance offers its services so that entrepreneurs can fulfill their financial requirements and thrive.

The entity has a diversified pan-India presence through its extensive network. As of December 31, 2022, SBFC Finance had established its footprints in over 105 cities in 16 Indian states and two union territories. They currently have 137 branches.

Objects of the Issue:

The Company proposes to utilize the Net Proceeds towards augmenting the Company's capital base to meet their future capital requirements arising out of the growth of the business and assets.

Company Promoter: SBFC Holdings Pte. Ltd., Clermont Financial Pte. Ltd., Arpwood Partners Investment Advisors LLP, Arpwood Capital Private Limited and Eight45 Services LLP are the company promoters.

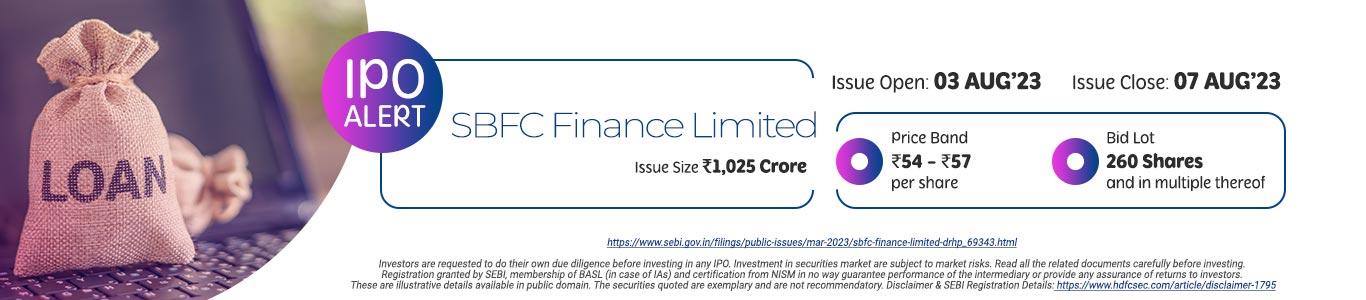

Issue Details

Company Financials

| Period Ended | 31-Mar-20 | 31-Mar-21 | 31-Mar-22 | 31-Dec-22 | 31-Mar-23 |

| Assets | 4,207.99 | 4,231.19 | 4,515.03 | 5,334.82 | 5,746.44 |

| Revenue | 444.85 | 511.53 | 530.7 | 531.69 | 740.36 |

| Profit After Tax | 35.5 | 85.01 | 64.52 | 107.03 | 149.74 |

| Net Worth | 752.09 | 944.72 | 1,026.78 | 1,421.63 | 1,466.88 |

| Reserves and Surplus | |||||

| Total Borrowing | 3,056.38 | 2,772.55 | 2,948.82 | 3,409.48 | 3,745.83 |

HSL Mobile App

HSL Mobile App