Srei Equipment Finance Limited NCD

SREI Equipment Finance limited (SEFL) is the leading financier in Construction, Mining and allied Equipment (“CME”) sector in India with an approximately 32.7% market share fiscal 2017. Its product offering include loans, for new and used equipment and leases.

As of September 30, 2017, SEFL had a presence in approximately 21 states, through its 89 branches and four offices across India.

Issue Details

| Issuer | Srei Equipment Finance Limited |

| Issue Size | Rs 1000 Crore |

| Issue |

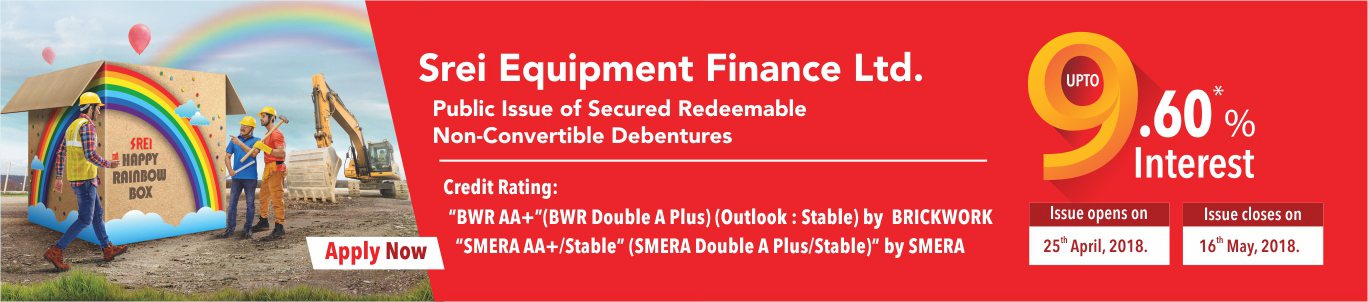

Public Issue by the Company of Secured Redeemable Non-Convertible Debentures of face value of Rs 1,000/- for an amount up to Rs 500 Crores (Base Issue Size) with an option to retain over subscription upto additional NCDs of face value of Rs 1,000/- each, for an amount upto Rs 500 Crores, aggregating to Rs 1000 Crores (Overall Issue Size) |

| Rating | SMERA AA+/ Outlook -Stable by SMERA Rating and BWR AA+ / Outlook Stable by BRICKWORK Ratings |

| Issue opens |

April 25, 2018 |

| Issue closes | May 16, 2018 |

| Issue Price | Rs. 1,000 per NCD |

| Minimum Application | Rs 10,000/- (10 NCDs) across all Series and in multiples of 1 (one) NCD of Rs 1,000/- each thereafter |

| Coupon Type | Fixed Coupon Rates |

| Listing | The NCDs are proposed to be listed on BSE |

SPECIFIC TERMS FOR EACH SERIES OF NCDs

| Terms and conditions in connection with Secured NCDs***Options | I# | II# | III# | IV*** | V# | VI# | VII | VIII# | IX# | X | XI# | |

| Frequency of Interest Payment | N.A. | Annual | Monthly | Annual | N.A. | Monthly | Annual | N.A. | Monthly | Annual | N.A. | |

| Minimum Application | Rs 10,000/- (10 NCDs) across all Series and in multiples of 1 (one) NCD thereafter | |||||||||||

| Issue Price (Rs/ NCD) | Rs 1,000 | |||||||||||

| Tenor from Deemed Date of Allotment | 400 days |

3 Years |

5 Years |

10 Years | ||||||||

| Coupon (% per annum) for Category I, Category II & Category III Investor(s) | N.A. | 8.50% | 8.75% | 9.10% | N.A. | 9.00% | 9.35% | N.A. | 9.20% | 9.60% | N.A. | |

|

Effective Yield (per annum) for Category I, Category II & Category III Investor(s) |

8.54% | 8.60% | 9.10% | 9.12% | 9.10% | 9.37% | 9.37% | 9.35% | 9.59% | 9.60% | 9.60% | |

| Mode of Interest Payment | Through various mode available. | |||||||||||

|

Amount (Rs/NCD) on Maturity for Category I, Category II & Category III Investor(s) |

Rs 1,094/- | Rs 1,000/- | Rs 1,000/- | Rs 1,000/- | Rs 1,299/- | Rs 1,000/- | Rs 1,000/- | Rs 1,564/- | Rs 1,000/- | Rs 1,000/- | Rs 2,503/- | |

| Maturity Date (from Deemed Date of Allotment) | 400 days |

3 Years |

5 Years |

10 Years | ||||||||

All category of investors can subscribe to all Series of NCDs

*** The Company shall allocate and allot Series IV NCDs wherein the Applicants have not indicated their choice of the relevant NCD Series.

ALLOCATION RATIO

| Institutional Portion | Non-Institutional Portion | Individual Category Portion |

| 20% of Overall Issue Size | 20% of Overall Issue Size | 60% of Overall Issue Size |

COMPANY PROFILE

• SREI Equipment Finance limited (SEFL) is the leading financier in Construction, Mining and allied Equipment (CME) sector in India with an approximately 32.7% market share fiscal 2017. Its product offering include loans, for new and used equipment and leases..

• As of September 30, 2017, SEFL had a presence in approximately 21 states, through its 89 branches and four offices across India.

• SEFL has different business verticals like CME (including used equipment), Tippers, IT and allied equipment, Medical and Allied equipment, Farm equipment and Other assets.

• SEFLs disbursements for the nine months ended December 31, 2017 were Rs 12,612 crore.

• The AUM of the Company increased from Rs 18,348.43 crore as of March 31, 2015 to Rs 28,522.18 crore as of December 31, 2017. Net worth of the company rose to Rs 2642.2 crore as on December 31, 2017 from Rs 2208.8 crore in FY15.

• Net profit increased to Rs. 181.98 crore as on December 31, 2017 from 148.84 in FY17. Net Interest Margin(NIM) rose to 5.26% for the nine months ended December 31, 2017 from 4.92% in FY17.

• Capital adequacy ratio (CRAR) of SEFL stood at 16.09% for the nine months ended December 31, 2017. Similarly, Net NPA ratio declined to 1.39% for the nine months ended December 31, 2017 from 1.76% in FY17.

• For the nine months ended December 31, 2017, the total loans disbursed were Rs 10,481.12 crore, which accounted for 83.10% of the total disbursements of SEFL.

HSL Mobile App

HSL Mobile App