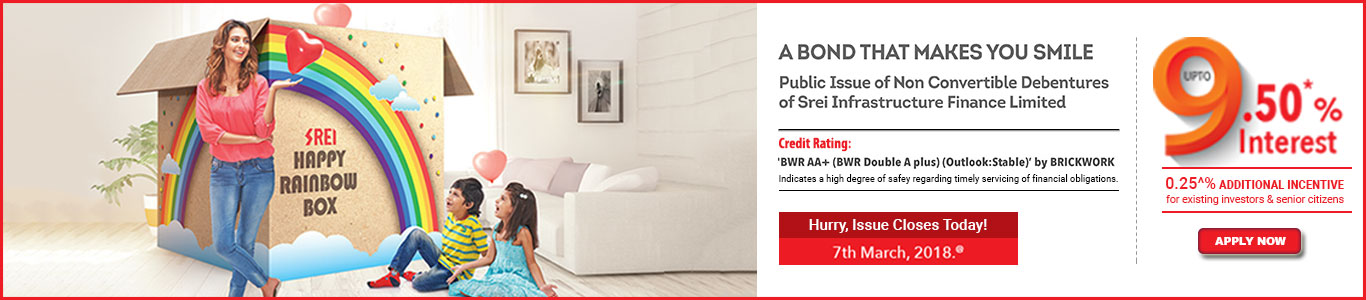

SREI Infrastructure Finance Ltd - NCD

| Issuer | SREI Infrastructure Finance Ltd |

| Issue Size | Rs 2000 Crore |

| Issue | Public Issue of Secured & Unsecured , Subordinated, Redeemable Non-Convertible Debentures of the Company of face value of Rs 1,000/- Each , for an amount upto Rs 200 Crs ( Base Issue Size) with an option to retain over-subscription upto Shelf limit of Rs 2000 Crs ( Over All Issue Size- Tranche 1 Issue) |

| Rating | BWR AA+ (BWR Double A Plus) (Outlook: Stable)’ by BRICKWORK |

| Issue opens |

Friday , 9th Feb 2018 |

| Issue closes | Wednesday , 7th March 2018 |

| Issue Price | Rs. 1,000 per NCD |

| Minimum Application | Rs 10,000/- (10 NCDs) across all Series and in multiples of 1 (one) NCD of Rs 1,000/- each thereafter |

| Coupon Type | Fixed Coupon Rates |

| Listing | The NCDs are proposed to be listed on BSE and NSE, within 12 Working Days from the Issue Closing Date. |

SPECIFIC TERMS FOR EACH SERIES OF NCDs

| Series | I | II | III | IV | V | VI | VII | VIII | IX | X | XI |

| Frequency of interest Payment | N.A. | Annual | Monthly | Annual | N.A. | Monthly | Annual | N.A. | Monthly | Annual | N.A. |

| Minimum Application | Rs. 10,000/- (10 NCD) across all series collectively | ||||||||||

| Nature of Instruments | Secured | Secured | Secured | Unsecured Subordinated | |||||||

| Tenor from Deemed Date of Allotment | 400 days | 3 years | 5 years | 10 years | |||||||

| Coupon (% per annum) for Category I, Category II, Category III & Category IV investor(s) | N.A. | 8.50% | 8.43% | 8.75% | N.A. | 8.65% | 9.00% | N.A. | 9.11% | 9.50% | N.A. |

| Effective yeild (per annum) for Category I, Category II, Category III & Category IV investor(s) | 8.54% | 8.51% | 8.75% | 8.77% | 8.77% | 8.99% | 9.01% | 9.01% | 9.50% | 9.49% | 9.50% |

| Mode of Interest payment | Through various mode available | ||||||||||

| Amount (Rs./ NCD) on maturity for Category I, Category II, Category III & Category IV investor(s) | Rs.1094/- | Rs.1000/- | Rs.1000/- | Rs.1000/- | Rs.1287/- | Rs.1000/- | Rs.1000/- | Rs.1540/- | Rs.1000/- | Rs.1000/- | Rs.2480/- |

| Maturity Date (from Deemed Date of Allotment) | 400 days | 3 years | 5 years | 10 years | |||||||

*The Company shall allocate and allot Series I NCDs wherein the Applicants have not indicated their choice of the relevant NCD Series

COMPANY PROFILE

· Srei Infra is a holistic infrastructure institution.

· Srei is a RBI registered non-deposit taking NBFC.

· Classified as an “Infrastructure Finance Company” in the year 2011 by RBI.

· Notified as “Public Finance Institution” status by the MCA, under section 4A of Companies Act, 1956 (now Section 2(72) of the Companies Act, 2013).

- A listed entity on “BSE” and “NSE” and CSE.

Key Strengths:

• Over 27 years of experience in the infrastructure financing sector in India.

• Diversified product portfolio and presence across the infrastructure space to boost the growth path.

• With a large customer base and Rs 374,129 million of Consolidated Asset Under Management as on March 31, 2017

• Experienced Management team to steer ahead the Company in its growth path.

• Consolidated group Net worth is Rs 48,154 million and Profit After Tax is Rs 2,433 million for the year ended March 31, 2017.

How To Invest in NCD's:

|

Click to read Report

|

HSL Mobile App

HSL Mobile App