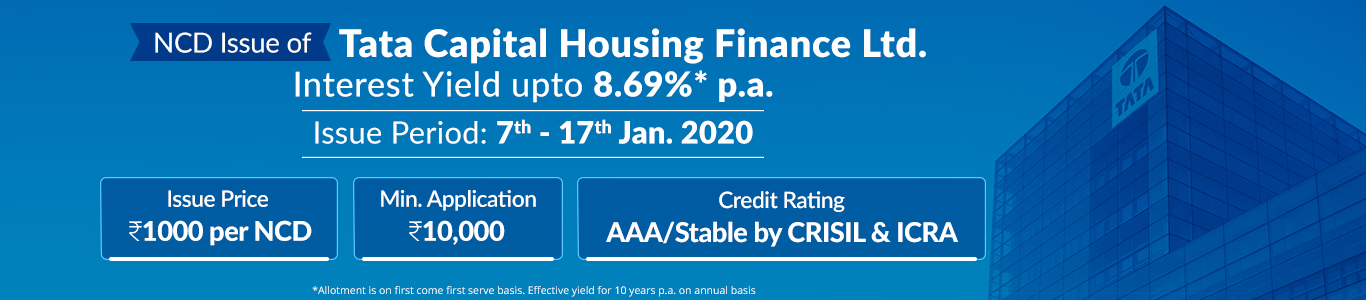

Tata Capital Housing Finance Ltd NCD

Tata Capital Housing Finance Ltd is coming up with the 1st tranche of public issue of secured, redeemable non-convertible debentures of face value of Rs 1,000 each and Unsecured, subordinated, rated, listed, redeemable, non-convertible debentures of Face value of Rs 1,000 for an amount of Rs 500 Crore (“Base Issue Size”) with an option to retain oversubscription up to Rs 1500 Crore (totaling Rs. 2,000 Crore) within the Shelf limit of Rs. 5,000 Crore.

The issue will open for subscription from January 07, 2020 to January 17, 2020 (The Issue shall remain open for subscription during the period indicated above except that the Issue may close on such earlier date or extended date as may be decided by an Authorised personnel authorized by the Board of Directors of the Company). The company will be paying an interest ranging between 8.00% and 8.70 % p.a. on these bonds.

The NCDs proposed to be issued under this Issue have been rated “CRISIL AAA/Stable”, “[ICRA] AAA (stable)”. Instruments with this rating are considered to have

highest degree of safety regarding timely servicing of financial obligations. Such instruments carry very lowest credit risk.

Issue Details

| Issuer | Tata Capital Housing Finance Limited ( View Report ) |

| Issue Size | Public issue of secured, redeemable non-convertible debentures of face value of Rs 1,000 each and Unsecured, subordinated, rated, listed, redeemable, non-convertible debentures of Face value of Rs 1,000 for an amount of Rs 500 Crore (“Base Issue Size”) with an option to retain oversubscription up to Rs 1500 Crore (totaling Rs. 2,000 Crore) within the Shelf limit of Rs. 5,000 Crore. |

| Issue opens | Tuesday , 07th January 2020 |

| Issue closes | Friday , 17th January 2020 |

| Allotment | First Come First Serve Basis, Compulsory in demat form |

| Face Value | Rs 1000 per NCD |

| Issue Price | Rs 1000 per NCD |

| Type and nature of instrument and seniority |

Secured NCDs of face value of Rs 1,000 each and Unsecured NCDs of face value Rs 1,000 each |

| Minimum Application | Rs 10,000 (10 NCDs) collectively across all Series and in multiple of Rs 1,000 (1 NCD) thereafter across all Series |

| Rating | ““CRISIL AAA/Stable” by CRISIL and “[ICRA] AAA (stable)” by ICRA |

| Security and Asset Cover | The Secured NCDs would constitute secured obligations of Tata Capital Housing Finance Ltd and shall rank pari passu inter se, present and future and subject to any obligations under applicable statutory and/or regulatory requirements, shall be secured by way of a first ranking pari passu charge by way of mortgage over Tata Capital Housing Finance Ltd’s specific immovable property and a first ranking pari passu floating charge over the movable properties of the Company, including book debts (excluding the exclusive charge created by the Company in favour of NHB as security for the due repayment for financial assistance by way of refinancing granted by NHB to Tata Capital Housing Finance Ltd). Tata Capital Housing Finance Ltd will create appropriate security in favour of the Debenture Trustee for the Secured NCD Holders on the assets adequate to ensure 100% asset cover for the secured NCDs (along with the interest due thereon). No security will be created for Unsecured NCDs in the nature of Subordinated Debt. The rated, listed, redeemable Unsecured NCDs are in the nature of subordinated debt and will be eligible for Tier II Capital |

| Series | I | II | III | IV | V | VI |

| Frequency of Interest Payment | Annual | Monthly | Annual | Monthly | Annual | Annual |

| Type of NCD | Secured | Secured | Secured | Secured | Secured | UnSecured |

| Tenor | 36 Months | 60 Months | 60 Months | 96 Months | 96 Months | 120 Months |

|

Coupon (% per annum) for NCD Holders in Category I and II |

8.00% | 7.92% | 8.20% | 8.01% | 8.30% | 8.55% |

|

Coupon (% per annum) for NCD Holders in Category III and IV |

8.10% | 8.01% | 8.30% | 8.10% | 8.40% | 8.70% |

|

Effective Yield (% per annum) for NCD holders in Category I & II |

7.99% | 8.21% | 8.19% | 8.30% | 8.29% | 8.54% |

|

Effective Yield (% per annum) for NCD holders in Category III & IV |

8.09% | 8.30% | 8.29% | 8.40% | 8.39% | 8.69% |

|

Put and call option |

NA | |||||

|

Amount (Rs / NCD) on Maturity for NCD Holders in Category I, II, III & IV |

1000 | 1000 | 1000 | 1000 | 1000 | 1000 |

|

Minimum Application |

Rs 10,000 (10 NCDs) across all Series collectively | |||||

|

In multiples of thereafter |

Rs 1,000 (1 NCD) | |||||

|

Face Value / Issue Price (Rs Per NCD) |

Rs 1,000 (1 NCD) | |||||

|

Mode of InterestPayment |

Through various options available | |||||

Allocation Ratio

| Institutional Portion | Non-Institutional Portion | High Net Worth Individual Portion | Retail Individual Investor Portion |

| 10% of the Overall Issue Size | 10% of the Overall Issue Size | 40% of the Overall Issue Size | 40% of the Overall Issue Size |

HSL Mobile App

HSL Mobile App